Ford Scales Back EV Plans

The automaker takes a $19.5 billion hit and shifts its strategy toward hybrids

Ford Will Take a $19.5 Billion Hit as It Rolls Back Electric Vehicle Plans

Slower EV demand and policy changes force Ford to rethink its electrification strategy

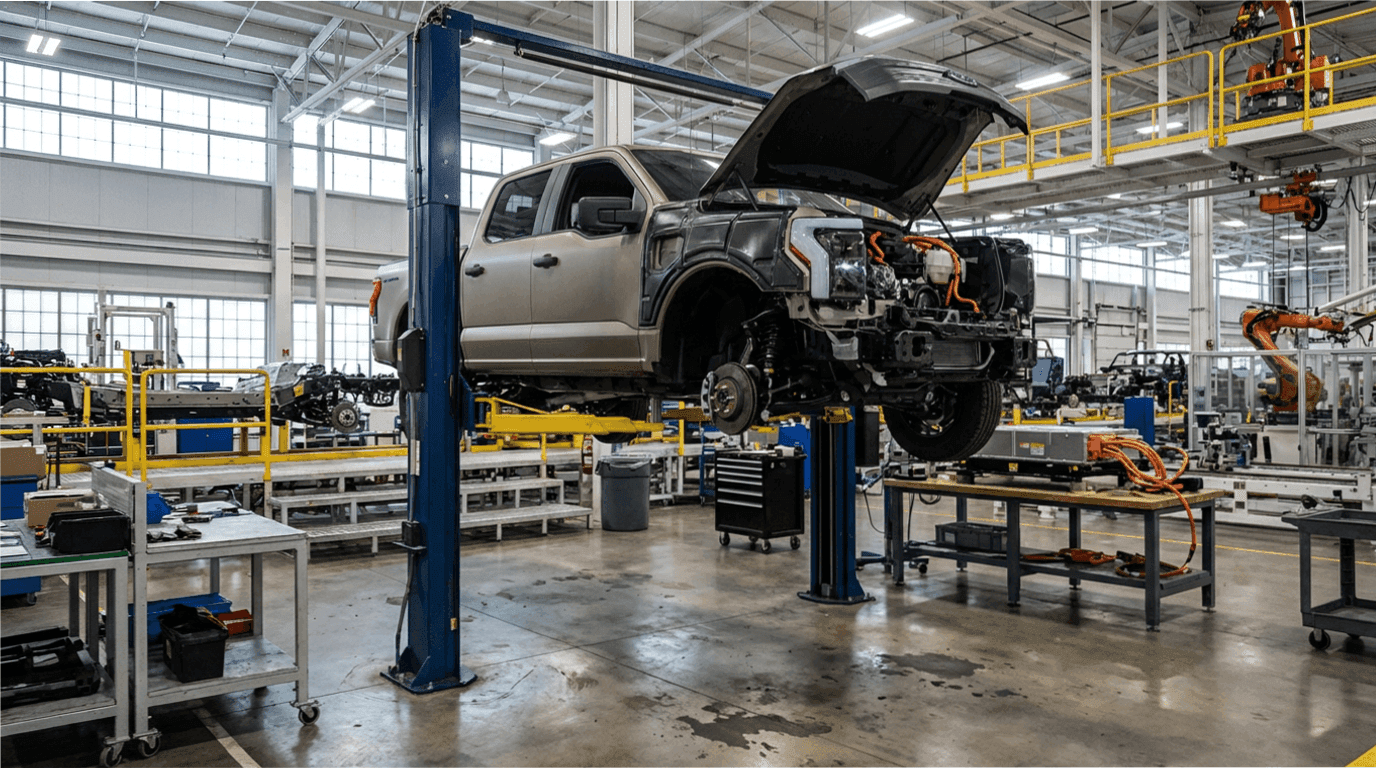

Ford Motor announced it will take a $19.5 billion charge after scaling back its electric vehicle plans and increasing its focus on hybrids that combine gasoline engines with electric motors. The decision marks a significant reversal for one of America’s largest automakers and reflects a broader slowdown in the push toward full electrification.

For U.S. drivers, this shift directly affects which vehicles reach dealerships, how much they cost, and how quickly fully electric options expand across the market.

Why Ford Is Rolling Back Its EV Ambitions

Ford admitted it overestimated near-term demand for battery-electric vehicles while underestimating the staying power of gasoline and diesel-powered models. While EV adoption continues, consumer interest has softened amid higher prices, charging limitations, and uncertainty around resale values.

According to U.S. motor vehicle sales data, trucks and SUVs remain the most popular vehicle categories in the United States — segments where hybrids often provide a more practical solution than fully electric powertrains.

Hybrids Offer a Safer Middle Ground

Instead of abandoning electrification entirely, Ford is repositioning hybrids as a core pillar of its future lineup. Hybrids reduce fuel consumption while avoiding the high costs and infrastructure challenges associated with large battery packs.

This approach allows Ford to maintain manufacturing flexibility, control costs, and meet regulatory requirements while continuing to serve customers who are not ready to switch to fully electric vehicles.

Government Policy Has Shifted the Incentives

Ford’s strategic reset also reflects changes in U.S. government policy. Since early 2025, incentives for electric vehicles have been reduced, and fuel economy rules have been relaxed. Updates to Corporate Average Fuel Economy (CAFE) standards have lowered regulatory pressure to rapidly expand EV production.

With fewer policy-driven constraints, automakers now have more freedom to align production with real consumer demand rather than aggressive electrification timelines.

What the $19.5 Billion Charge Covers

The charge includes write-downs of EV platforms, factory retooling costs, canceled or delayed projects, and supplier contract changes. Ford described the move as a one-time strategic correction intended to protect long-term profitability.

What This Means for Ford Buyers

For consumers, Ford’s shift is likely to result in:

- More hybrid trucks and SUVs

- Fewer near-term all-electric launches

- Less aggressive EV discounting

- More stable pricing across high-demand models

Ford emphasized that electric vehicles remain part of its long-term roadmap, but future investments will be paced more cautiously.

Ford’s $19.5 billion reset highlights a growing reality across the auto industry: the transition to electric vehicles will be slower and more uneven than early forecasts suggested. By pivoting toward hybrids, Ford aims to balance affordability, regulatory compliance, and profitability.

For drivers, this likely means more practical vehicle choices — and a more gradual path toward full electrification.

More from Car Market

What’s Happening in the U.S. Car Market Right Now: Price Trends, Demand Shifts, and Key Reasons Behind Them

A 2025 Deep Dive Into Pricing Dynamics, Market Behavior, and Consumer Demand

21.11.2025 13:23

What Will Happen to New Car Prices in 2026?

A Detailed Forecast of U.S. New Vehicle Pricing, Market Forces, and Buyer Expectations

21.11.2025 12:31

Where Is It Most Cost-Effective to Buy a Car in the U.S. in 2025?

A Deep, State-by-State Breakdown of Pricing, Taxes, Market Trends, and Real Savings

21.11.2025 11:09