The Race to Build Electric Motors Without Chinese Rare Earths

For more than a decade, electric automakers have relied on the same essential ingredient: rare-earth magnets, most of which are mined or processed in China. But as geopolitical tensions rise and supply chains become more unpredictable, car companies are accelerating the search for one of the industry’s biggest breakthroughs — high-performance electric motors that require no rare-earth materials at all.

Manufacturers in the U.S., Europe, Korea, and Japan now see rare-earth independence as a strategic necessity, not just an engineering challenge. The result is a global race to develop new materials, redesigned motor architectures, and cleaner manufacturing processes that could reshape the EV market in the coming decade.

Why Automakers Are Trying to Escape Rare-Earth Dependency

Rare-earth magnets — especially neodymium, dysprosium, terbium, and praseodymium — are critical for the permanent magnet motors used in most electric vehicles today. They allow high torque, better efficiency, and compact motor designs.

But the industry has a problem:

China controls the overwhelming majority of rare-earth mining and processing.

Depending on the estimate, the number ranges from 60% to 90% of global output.

This creates three major pressures automakers can no longer ignore:

1. Geopolitical risk

Trade tensions, export restrictions, and national-security disputes make rare-earth access uncertain. A single policy shift can disrupt global EV production.

2. Price volatility

Rare-earth metals are notorious for sudden price spikes. Carmakers struggle to forecast long-term costs — terrible for EV profitability.

3. Sustainability concerns

Mining and refining rare earths come with environmental challenges, including waste pollution and energy-heavy chemical processing.

Manufacturers want a future where EV production is stable, local, and predictable — not dictated by global politics.

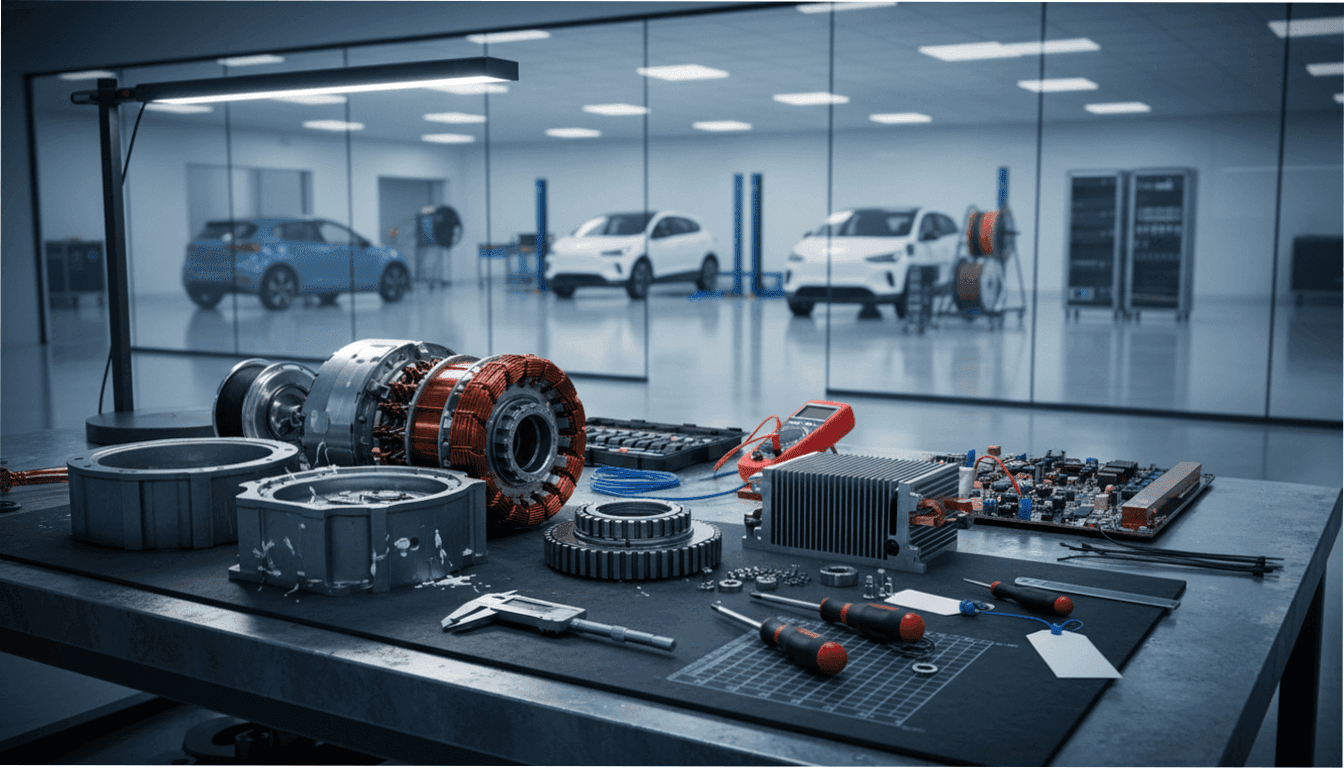

The Solutions Automakers Are Developing Right Now

Carmakers aren’t simply waiting for market conditions to stabilize — they’re actively building alternatives. Across the industry, three major approaches are gaining traction:

Switching to Induction Motors (No Magnets Needed)

Unlike permanent-magnet motors, induction motors create magnetic fields electronically rather than relying on rare-earth materials.

Companies exploring this approach:

Tesla (Model S and X historically used induction)

Mercedes-Benz

GM (select Ultium configurations)

Pros:

No rare-earth elements required

More stable supply chain

Lower material dependence

Cons:

Less efficient than permanent-magnet motors

Slightly heavier and larger

More heat generation

Expect induction-based systems to make a comeback as companies prioritize independence over absolute efficiency.

Building New Types of Permanent Magnets — Without Rare Earths

Researchers and material-science companies are developing alternative magnetic alloys, including:

iron-nitride magnets

manganese-based compounds

nanocrystalline materials

hard ferrites with boosted performance

A few suppliers claim early prototypes already match 70–80% of rare-earth magnet power — enough for some EV applications.

Scaling up remains the challenge, but the interest (and funding) is significant.

Hybrid Motor Designs and Reduced Rare-Earth Usage

Some companies are not eliminating rare earths entirely but minimizing them.

Approaches include:

optimizing rotor geometry

reducing dysprosium use with smart cooling systems

using laminated steel innovations

combining permanent magnets with switched-reluctance technologies

This middle-ground approach could cut rare-earth use by 30–70% without sacrificing much performance.

Who Is Leading the Rare-Earth-Free Motor Race?

While the industry as a whole is investing heavily, several companies stand out:

Toyota

Long-term R&D in magnet alternatives (iron-based and ferrite magnets) with large-scale testing programs.

BMW

Working on magnet-free motors for next-generation EV platforms.

GM

Developing rare-earth-reduced Ultium motors and exploring North American material suppliers.

Tesla

Publicly stated plans to shift future motors to “zero rare earths,” with the next platform expected to rely less on traditional supply chains.

European suppliers (Schaeffler, Mahle, ZF)

Pioneering magnet-less axial-flux and reluctance motors, claiming major efficiency improvements.

The industry is still early in the transition, but momentum is accelerating.

How Rare-Earth-Free Motors Could Change the EV Market

If automakers succeed, the shift will have major ripple effects:

More stable EV prices

Less exposure to geopolitical swings means fewer sudden markup cycles.

Cleaner production

Magnet-free motors eliminate the environmentally messy rare-earth refining stage.

New manufacturing hubs

U.S. and European production becomes more viable without dependence on imported materials.

More durable motors

Reluctance and induction designs can be simpler and more robust long-term.

A more competitive market

Companies that break free from rare-earth constraints will have a huge cost and branding advantage.

This is why the race isn’t just scientific — it’s strategic.

The Bottom Line

The EV industry quietly faces one of its biggest turning points: whether it can build high-performance electric motors without relying on rare-earth materials controlled largely by China.

The shift won’t happen overnight. But automakers around the world are clearly preparing for a future where supply chains are more local, more stable, and more sustainable. Rare-earth-free motors may soon move from experimental prototypes to mass production — and when that happens, the global EV market will look very different.

More from News

Are Lexus F Models Disappearing? The Uncertain Future of the Brand’s Performance Division

21.11.2025 19:05

Tesla Might Finally Add Apple CarPlay — Here’s What That Means for Drivers

21.11.2025 19:17

How New U.S. Tariffs on Japanese Cars Will Impact You

23.11.2025 14:59