Why Tesla’s Latest Earnings Report Is a Warning Sign — And What It Means for the EV Market

Tesla’s late-October 2025 earnings report delivered a mixed—and unsettling—message: vehicle deliveries remain strong, yet profits have dropped sharply compared to the previous year. This contrast has raised serious questions among investors, analysts, and EV drivers about where the company is heading as it enters 2026.

Below is a deeper, clearer breakdown of what’s really happening behind the numbers and what it could mean for Tesla buyers and the wider EV industry.

Strong Sales, Weak Margins — The Red Flag in Tesla’s Q3 Results

Despite reporting solid revenue, Tesla posted a significant decline in net profit. According to public financial reporting, this marks the fourth consecutive quarter of falling profitability. Rising material costs, heavier competition, and broader price cuts are the main reasons margins continue to shrink.

For an automaker that built its brand on premium positioning and high profitability, this trend is a major concern.

What’s Squeezing Tesla’s Profitability?

Tesla’s bottom line is being impacted by several converging pressures:

Materials and component costs continue rising, especially batteries and semiconductors.

Price cuts and incentives introduced to stay competitive reduce revenue per vehicle.

Expansion into robotics and autonomous driving adds heavy R&D expenses.

More competition than ever from Chinese, Korean, European, and U.S. automakers.

Tesla’s push for aggressive growth has also meant prioritizing volume over margin in some markets, increasing long-term strain.

What This Means for Tesla Buyers in 2026

If Tesla continues to experience margin pressure, consumers may see:

fewer deep discounts

slower rollout of new hardware features

simplified vehicle configurations

possible adjustments to service or support policies

Meanwhile, competing EV makers are using this moment to push more aggressively into the U.S. market, often with more affordable price points or longer warranties.

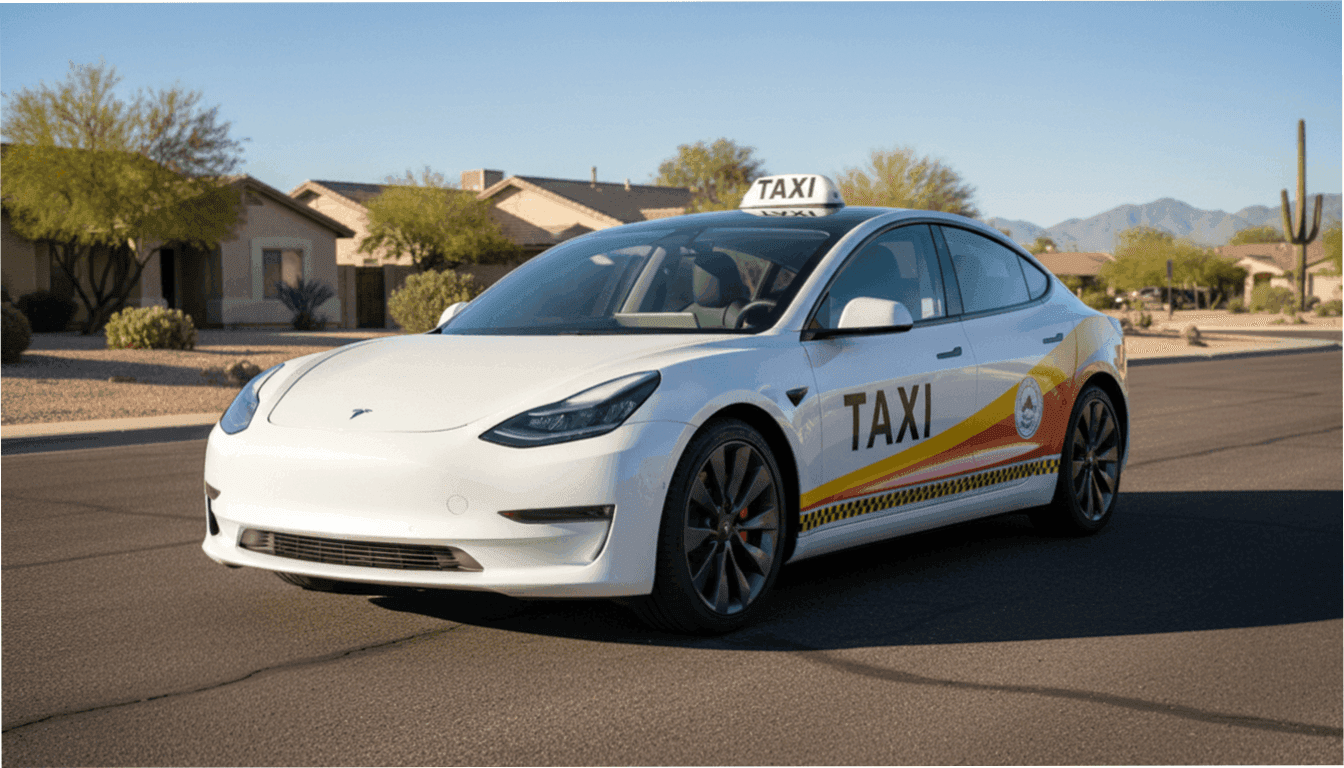

Tesla’s Shift Toward AI, Robotics, and Subscriptions

Despite short-term financial pressure, Tesla remains focused on long-term strategic bets. CEO Elon Musk highlighted robotics, real-world AI, and autonomous mobility as core priorities during recent earnings commentary.

If Tesla succeeds in these areas, it could build revenue streams independent of car sales. But these are high-risk, high-investment initiatives that may take years to materialize.

What Consumers Should Pay Attention To

If you're considering buying a Tesla or another EV, watch for:

pricing changes

delivery timelines

updates (or delays) in FSD or autonomy features

resale trends

battery policy adjustments

This earnings downturn doesn’t mean Tesla is in trouble — but it does mean buyers should stay alert to changes in product and pricing strategy heading into 2026.

Tesla’s Q3 2025 earnings reflect a company at a crossroads: still selling vehicles at strong volume, but struggling to maintain the margins that once set it apart. Whether this becomes a temporary dip or a lasting shift depends on Tesla’s ability to balance innovation, profitability, and competitiveness in an increasingly crowded EV landscape.

One thing is clear: 2026 will be a pivotal year not just for Tesla, but for the entire electric vehicle market.

More from News

Are Lexus F Models Disappearing? The Uncertain Future of the Brand’s Performance Division

21.11.2025 19:05

The Race to Build Electric Motors Without Chinese Rare Earths

02.12.2025 17:03

Tesla Might Finally Add Apple CarPlay — Here’s What That Means for Drivers

21.11.2025 19:17

How New U.S. Tariffs on Japanese Cars Will Impact You

23.11.2025 14:59