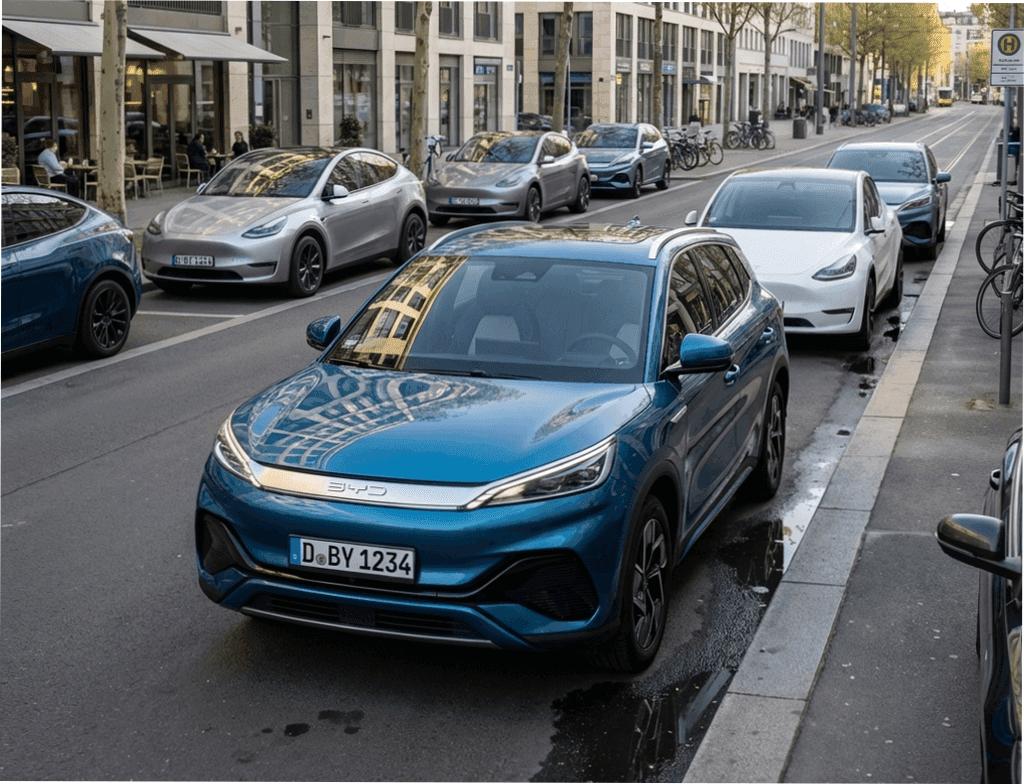

BYD’s European Sales Surge as Chinese Automakers Expand Across the Continent

Chinese automaker BYD continues building momentum in Europe, posting another strong month of registrations despite intensifying price pressure and slowing demand in its home market. According to the European Automobile Manufacturers’ Association (ACEA), BYD recorded 17,470 new-car registrations in Europe in October, a dramatic rise from just 5,695 units a year earlier.

At the same time, Tesla — once dominant in the European EV landscape — saw registrations fall 48% year-over-year, highlighting a significant market shift that could reshape the competitive dynamics of the continent’s electric-vehicle sector.

Why BYD Is Growing So Quickly in Europe

Even with economic uncertainty and fluctuating EV demand across the EU, BYD is one of the few automakers generating consistent monthly growth. Several factors contribute to this:

Aggressive pricing and strong value proposition

BYD offers well-equipped EVs with competitive range, advanced interiors, and lower prices than many European brands. In a cost-sensitive market, this advantage is proving powerful.

Expanding dealership and distribution networks

The company is rapidly setting up sales infrastructure across Germany, France, Italy, Spain, and the Nordic countries — giving BYD a visibility advantage previously enjoyed mostly by Western automakers.

Localized marketing and customer experience

European consumers increasingly perceive BYD not simply as a Chinese manufacturer, but as a global brand offering credible alternatives to established players.

Home market challenges pushing overseas expansion

With competition intensifying in China, international markets — especially Europe — have become essential for BYD’s long-term growth. This urgency accelerates its European push.

Tesla’s EU Decline: What’s Behind the 48% Drop?

Tesla’s registrations falling nearly 50% in the EU indicates not only stronger competition but also shifting consumer expectations:

More European buyers are choosing affordable compact EVs, a segment Tesla has yet to enter.

Price cuts early in the year may have pulled demand forward, reducing fall-season sales.

Rivals like BYD, MG, Hyundai, and Renault are offering more variety at lower prices.

Tesla’s product lineup is aging, with the Model 3 and Model Y facing newer, fresher competitors.

Analysts believe Tesla may recover some ground through updated models, but the trend suggests Europe is becoming one of its most challenging regions.

How BYD’s Growth Affects the European EV Market

BYD’s rising footprint is likely to reshape several aspects of Europe’s EV landscape:

1. A stronger push toward price competition

European automakers may be forced to introduce more affordable EVs to remain competitive.

2. Pressure on mid-market brands

Brands without strong EV identity — such as certain legacy European manufacturers — may lose share quickly.

3. Faster EV adoption overall

As lower-priced EVs become more available, charging infrastructure and policy support are expected to accelerate.

4. Growing regulatory scrutiny of Chinese automakers

Europe is increasingly sensitive to foreign price advantages and may explore tariff adjustments, anti-subsidy investigations, or new market controls.

BYD’s rise is positive for consumers but complex for policymakers and incumbent automakers.

Can BYD Sustain This Momentum?

The automaker’s ability to keep growing depends on several factors:

launching more models tailored for Europe

navigating potential EU regulatory pressure

expanding service networks quickly enough to support a larger customer base

managing logistics and supply chains as demand increases

Still, for now, BYD appears to be outpacing expectations and gaining traction faster than almost any other foreign EV brand.

BYD’s surge in European registrations — tripling year-over-year — signals a major shift in the continent’s EV environment. While Tesla faces declining demand, BYD is rapidly capturing consumers’ attention with competitive pricing, modern technology, and an ambitious expansion strategy.

As Europe heads into 2026, the battle for EV dominance is shaping into a direct contest between aggressive Chinese entrants and established Western manufacturers. BYD’s latest numbers suggest the company is well positioned to become one of Europe’s most influential electric-vehicle brands.

More from News

Are Lexus F Models Disappearing? The Uncertain Future of the Brand’s Performance Division

21.11.2025 19:05

Why Tesla’s Latest Earnings Report Is a Warning Sign — And What It Means for the EV Market

02.12.2025 17:19

The Race to Build Electric Motors Without Chinese Rare Earths

02.12.2025 17:03

Tesla Might Finally Add Apple CarPlay — Here’s What That Means for Drivers

21.11.2025 19:17

Li Auto Posts First Quarterly Loss in Three Years as Sales Slow Sharply

02.12.2025 16:32