China’s Auto Sales Decline for a Second Month, but Exports Hit Record Highs

China’s auto market continues to lose momentum, posting its second straight monthly decline in retail passenger-car sales. According to new data from the China Passenger Car Association (CPCA), November sales fell 8.1% year-over-year to 2.23 million units, with demand softening across multiple price segments. Compared with October, retail sales slipped another 1.1%, signaling a broader cooldown in the world’s largest automotive market.

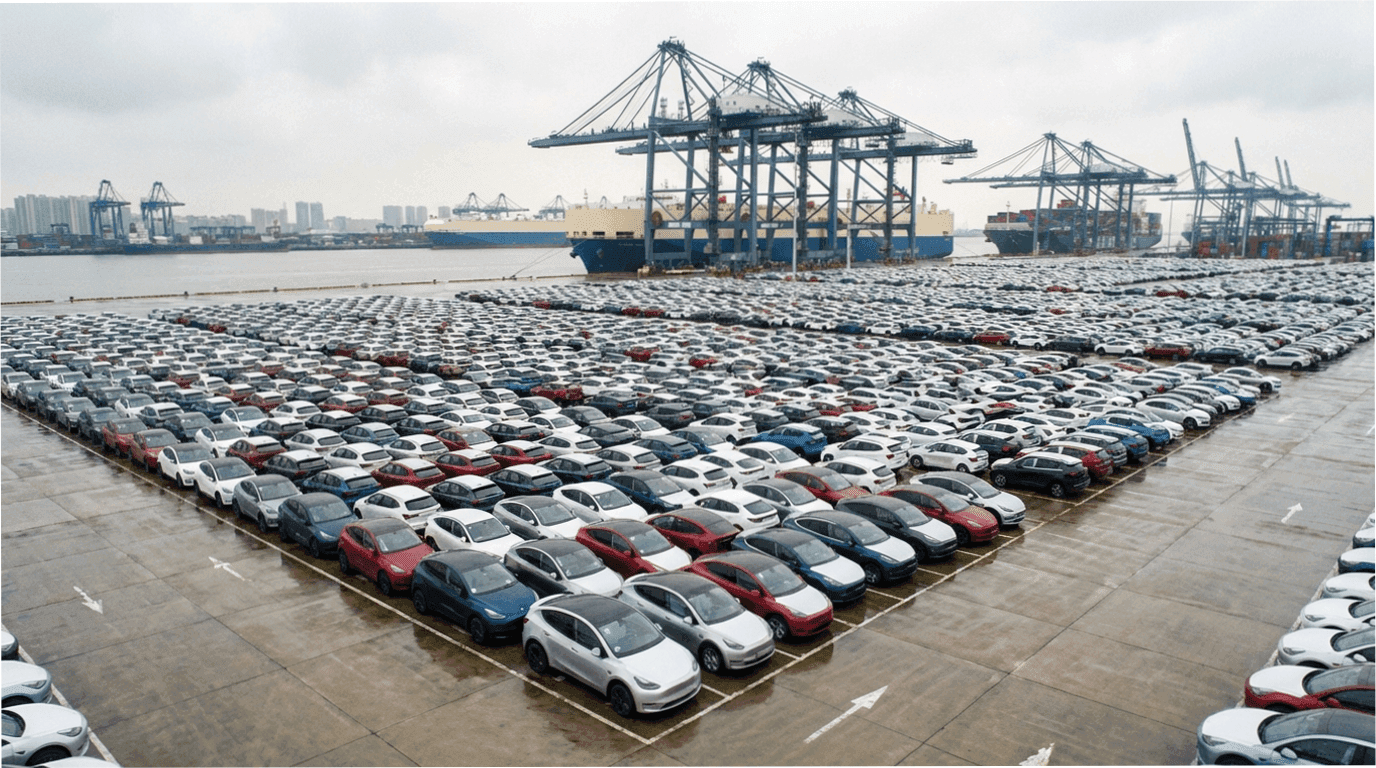

Yet even as local demand weakens, Chinese automakers are setting new records abroad. November passenger-car exports reached their highest levels ever, supported by strong demand for EVs, competitive pricing, and the rapid global expansion of brands like BYD, Chery, MG, Geely, and SAIC.

This contrast — shrinking domestic sales, booming exports — reflects a major shift in China’s auto strategy heading into 2026.

Domestic Sales Slow as Consumers Grow More Cautious

Several factors are weighing on China’s internal car market:

1. Slowing consumer confidence

Economic uncertainty, turbulent real-estate conditions, and tighter household budgets continue to suppress big-ticket purchases.

2. Intensifying competition and price wars

Aggressive discounting — particularly in the EV and hybrid segments — has trained consumers to delay purchases in hopes of deeper cuts.

3. Market saturation in major cities

Demand for entry-level and mid-range models has softened as many urban buyers already transitioned to EVs in earlier years.

These trends produced an unusually subdued November, even though late-year sales typically rise during promotional seasons.

Exports Are the Bright Spot: China Becomes a Global Automotive Power

While domestic sales slow, China’s automakers are thriving abroad. Passenger-car exports reached record highs in November, fueled by:

strong EV demand in Latin America, Eastern Europe, and the Middle East

increased shipments of affordable compact SUVs and sedans

aggressive international expansion strategies

competitive battery technology and pricing advantages

Several brands now export more units monthly than they sell domestically, a reversal of the pattern seen just five years ago. Chinese EVs continue gaining traction in markets where charging infrastructure is improving and price-sensitive buyers seek alternatives to Western and Japanese brands.

New-Energy Vehicles Expected to Stay Strong in December

Despite the broader downturn, China’s “new-energy vehicles” (NEVs) — EVs, plug-in hybrids, and range-extenders — remain resilient. The CPCA expects robust NEV sales in December due to:

end-of-year promotions

fleet purchases

strong export demand for EVs

increasing model variety at mid- and low-price tiers

NEVs are expected to outperform gasoline vehicles, keeping China at the center of global electrification trends.

Why China’s Auto Market Is Splitting Into Two Realities

China’s auto sector is undergoing a structural shift:

Domestic market:

slowing growth

too many models chasing limited demand

intense discount cycles

heavy marketing pressure

Export market:

strong appetite for affordable EVs

expanding international dealer networks

powerful cost advantages in batteries and supply chains

rising global brand recognition

This duality means China’s automakers are increasingly dependent on foreign markets to sustain growth — a trend that may only accelerate in 2026.

What to Watch Heading Into 2026

Industry analysts are tracking several key indicators:

Will domestic demand stabilize after the price wars cool down?

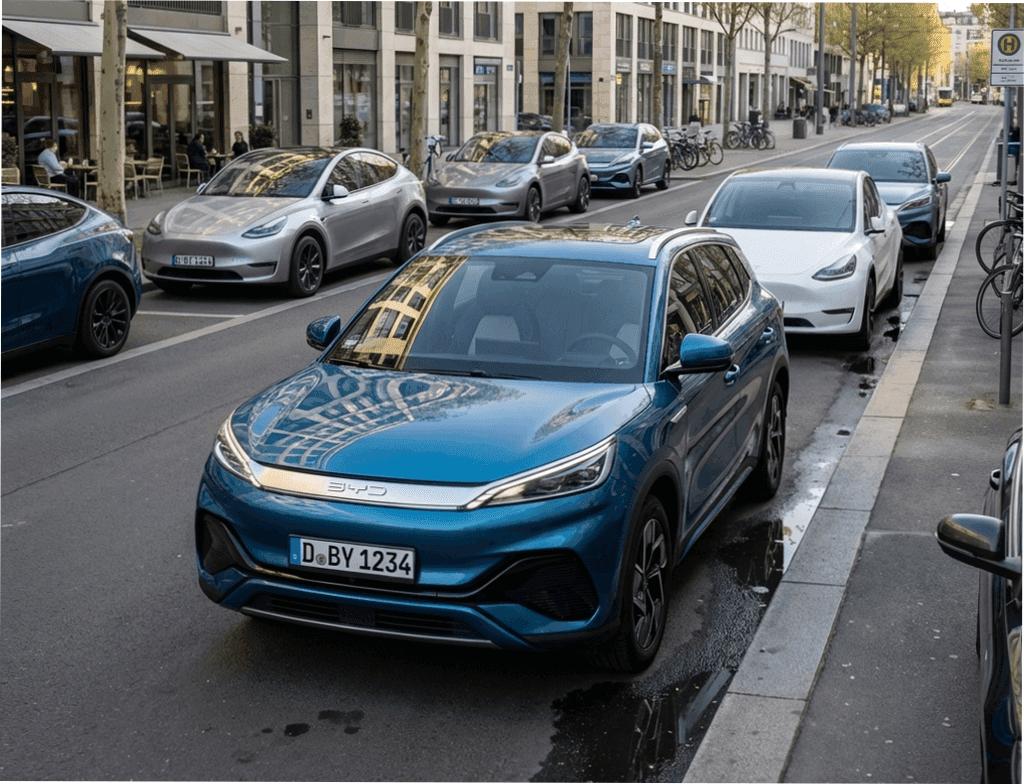

How will Europe respond to the surge in Chinese EV imports?

(Tariffs and anti-subsidy investigations are already underway.)Can NEV growth compensate for softening gasoline vehicle sales?

Will Chinese automakers overextend internationally or continue scaling sustainably?

The answers will determine how China’s global automotive influence evolves in the next three years.

China’s auto industry is entering a phase of sharp contrasts: domestic sales are weakening, yet exports are hitting unprecedented highs. For automakers, success will depend on balancing the challenges at home with the opportunities abroad — while adapting rapidly to global regulatory and competitive pressures.

More from News

Why Tesla’s Latest Earnings Report Is a Warning Sign — And What It Means for the EV Market

02.12.2025 17:19

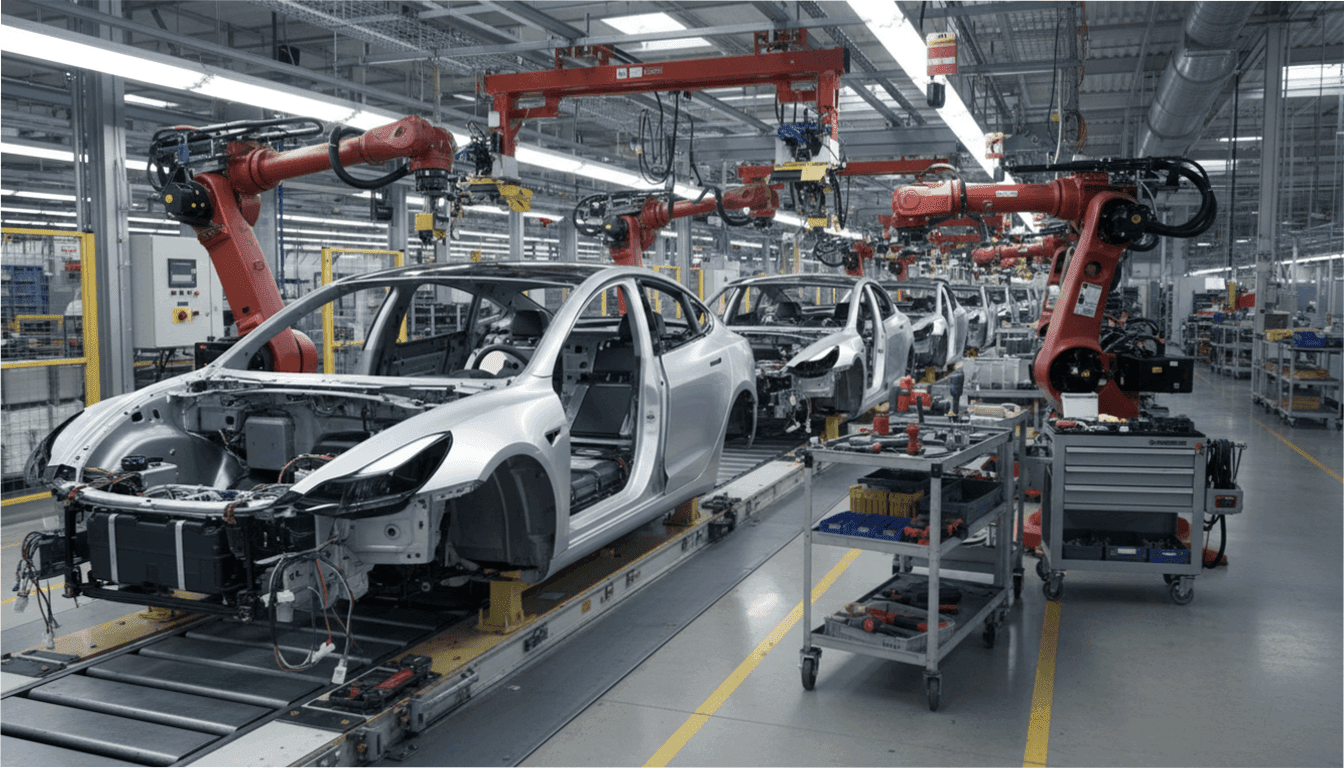

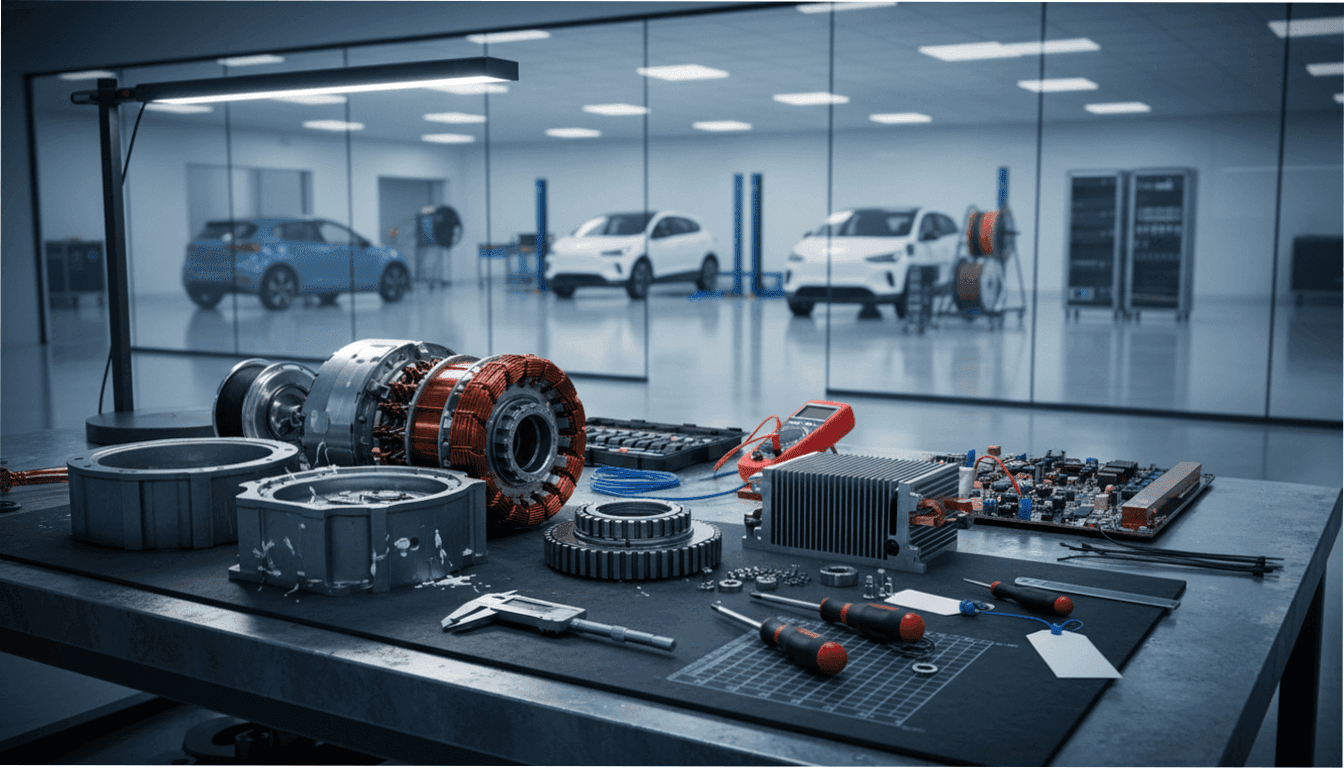

The Race to Build Electric Motors Without Chinese Rare Earths

02.12.2025 17:03

Tesla Might Finally Add Apple CarPlay — Here’s What That Means for Drivers

21.11.2025 19:17

BYD’s European Sales Surge as Chinese Automakers Expand Across the Continent

02.12.2025 17:11

Li Auto Posts First Quarterly Loss in Three Years as Sales Slow Sharply

02.12.2025 16:32