EV market enters a new phase without major incentives

The electric vehicle industry has reached a pivotal turning point. After years of rapid expansion fueled by generous government support, the market is transitioning into a more mature, self-sustaining stage where consumer choice, product excellence, and fundamental economics take center stage. This shift marks the end of an era defined by heavy reliance on purchase subsidies and the beginning of one driven by real-world competitiveness.

Why This Transition Represents True Maturation

For over a decade, major incentives served as the primary accelerator for EV adoption. They bridged the initial cost gap, stimulated manufacturing scale-up, and built essential infrastructure. Now, as these supports fade in many key markets, the industry faces a genuine test of its readiness.

This new phase isn't a setback — it's a necessary evolution. Markets that continue growing despite reduced policy support demonstrate genuine demand rather than artificial stimulus. Early indicators from various regions show that EV interest persists, powered by:

Improving total cost of ownership — lower energy and maintenance expenses

Technological maturity — longer ranges, faster charging, better performance

Expanding model diversity — options across segments and price points

Consumer familiarity — growing confidence from real-world experience

The transition separates sustainable players from those dependent on external aid, fostering healthier long-term competition.

Key Challenges in the Post-Incentive Landscape

Without major subsidies, several obstacles become more prominent:

Persistent price premium — EVs often remain more expensive upfront compared to equivalent conventional vehicles, particularly in mainstream segments

Regional disparities — Adoption varies dramatically depending on local energy costs, charging availability, and cultural attitudes

Infrastructure gaps — While networks expand, coverage remains uneven, especially outside urban centers

Battery concerns — Perceptions about longevity, replacement costs, and degradation persist despite strong warranties

Competition from hybrids — Plug-in and conventional hybrids gain traction as a lower-risk bridge technology

These challenges force manufacturers to rethink strategies, prioritizing efficiency, innovation, and customer-centric features over volume targets tied to policy deadlines.

Opportunities Emerging in the New Reality

The removal of heavy subsidies also unlocks significant opportunities:

Accelerated cost reduction — Intense competition drives down battery and production costs faster than anticipated

Focus on value-driven innovation — Emphasis shifts to superior driving dynamics, software features, and integrated ecosystems

Used market maturation — Growing supply of off-lease vehicles creates affordable entry points for mainstream buyers

Fleet and commercial adoption — Businesses with predictable routes and centralized charging benefit from clear operational savings

Supply chain resilience — Diversification and regional manufacturing reduce geopolitical risks and improve competitiveness

Manufacturers now compete on merit rather than incentive eligibility, rewarding those who deliver compelling products.

How Automakers Are Adapting to Succeed

Leading companies are responding strategically to this new environment:

Launching purpose-built, more affordable platforms designed from the ground up for electric propulsion

Offering creative ownership models, including flexible leasing and battery subscription services

Investing heavily in software and over-the-air updates to continuously enhance vehicle value

Expanding direct-to-consumer channels to improve margins and customer relationships

Prioritizing hybrid technologies alongside pure EVs to meet diverse consumer needs

These adaptations signal a shift from policy-dependent growth to market-driven innovation.

Regional Differences Shaping the Global Picture

The post-incentive phase looks different across major markets:

In some leading countries, EV sales continue upward even after subsidy reductions, proving strong underlying demand

Emerging markets benefit from affordable imported models, accelerating adoption without traditional Western-style incentives

Regions with high fuel costs and dense urban environments naturally favor electrification regardless of subsidies

Markets with strong domestic manufacturing focus on building long-term competitiveness through scale and technology

This diversity creates a more balanced global landscape, less dependent on any single policy framework.

What Drives Consumer Decisions in This Era

Today's EV buyers increasingly base choices on practical factors:

Daily usability — range confidence and charging convenience

Long-term economics — fuel savings and minimal maintenance

Driving experience — instant torque, quiet cabin, advanced driver assistance

Environmental alignment — personal values regarding emissions reduction

Technological appeal — seamless connectivity and regular feature updates

As these elements strengthen, EVs appeal to broader demographics beyond early adopters.

The electric vehicle market has entered an era where success depends on delivering superior products that stand on their own merits. While the transition brings short-term adjustments and regional variations, the underlying trajectory remains upward. Technology continues advancing, costs continue falling, and consumer acceptance continues growing — all independent of major government incentives.

This new phase, though more demanding, promises a healthier, more sustainable industry future built on genuine value rather than temporary support.

More from News

Chinese EVs Flooding North America? Xiaomi SU7, BYD & More Coming

07.01.2026 14:22

Ram TRX Returns with 777hp Supercharged V8 — Muscle Truck Wars Heat Up

07.01.2026 17:24

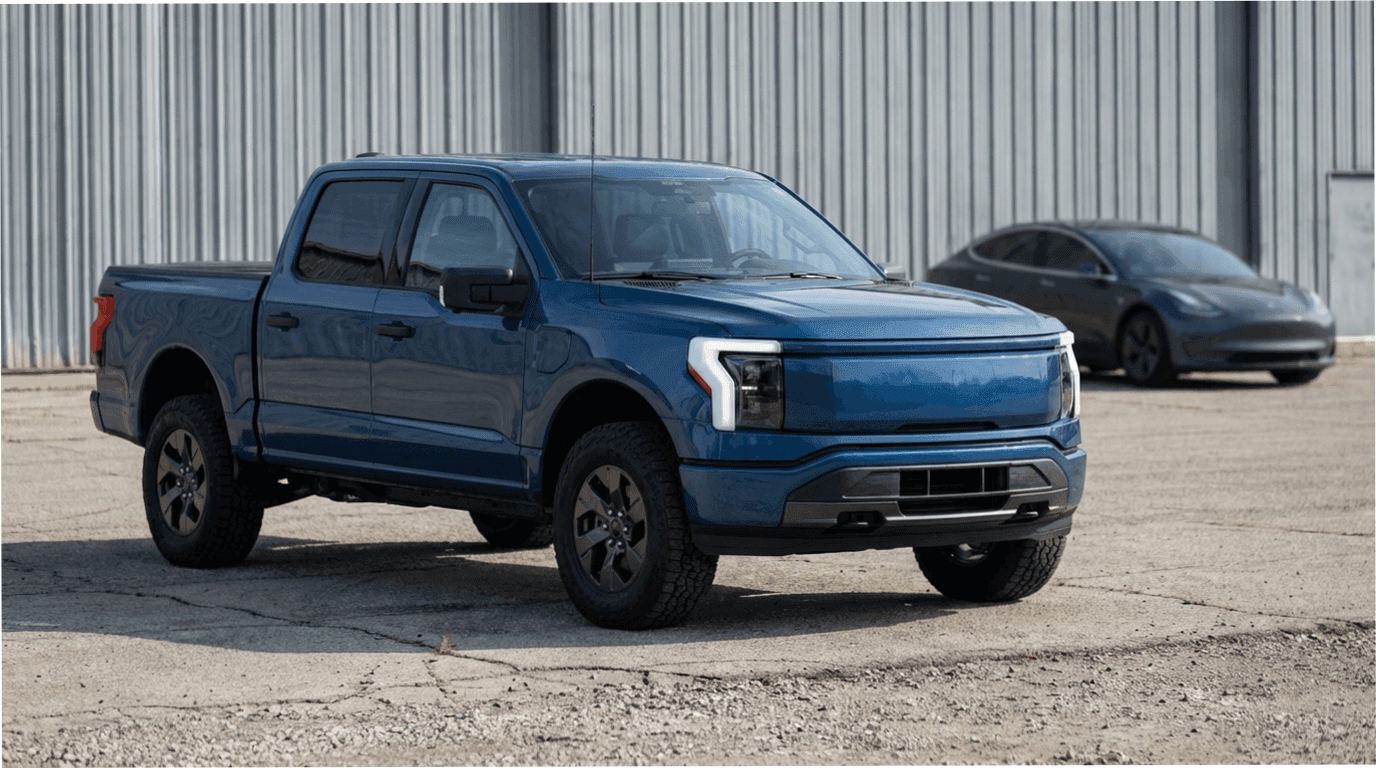

Why Ford Couldn’t Replicate Tesla’s EV Success

The electric F-150 impressed on paper but failed to meet the expectations set by Tesla

22.12.2025 18:47

Ford Shatters Recall Record — 12.9 Million Vehicles in 2025 Alone

08.01.2026 15:52

Hyundai & Kia Recall Over 1 Million Vehicles — What’s Actually Failing?

08.01.2026 15:40