U.S. automakers scale back EV plans amid shifting demand

The electric vehicle revolution in the United States, once heralded as unstoppable, has entered a phase of strategic recalibration. Major domestic manufacturers — Ford, General Motors, and Stellantis — are adjusting ambitious timelines, pausing facilities, and redirecting resources toward products that better match current buyer preferences. This shift reflects a complex interplay of market signals, consumer behavior, and evolving external factors.

The Initial EV Surge and Its Plateau

A few years ago, the industry operated under the assumption that electric vehicles would rapidly displace traditional gasoline models. Billions were invested in dedicated platforms, battery factories, and new assembly lines. Early adopters embraced the technology, drawn to instant torque, smooth acceleration, and the promise of lower operating costs.

Yet the broader market response proved more measured than anticipated. After an initial acceleration in sales — fueled partly by incentives — growth slowed considerably. Quarterly figures revealed sharp drops following policy adjustments, with EVs capturing a smaller slice of total new-vehicle transactions than many forecasts had predicted.

This softening demand prompted automakers to question whether full-speed commitment to electrification aligned with reality. Rather than risk overcapacity, they began reprioritizing profitable segments where consumer interest remains strongest.

Key Factors Driving the Demand Shift

Several interconnected elements explain why full battery-electric adoption has not accelerated as quickly as hoped:

Range anxiety persists — Many potential buyers still worry about long-distance travel and unexpected situations where charging access might be limited.

Home charging convenience varies — Apartment dwellers and renters often lack dedicated plugs, making daily recharging more challenging than for single-family homeowners.

Preference for familiar driving experiences — Large pickups and SUVs continue dominating sales, with buyers valuing towing capacity, payload capability, and the reassuring feel of a traditional powertrain.

Total cost considerations beyond fuel — Concerns about battery longevity, repair complexity, and resale uncertainty create hesitation among mainstream shoppers.

Hybrid appeal as a compromise — Vehicles offering electric-only driving for short trips combined with gasoline range freedom attract buyers who want electrification benefits without full commitment.

These realities have reshaped priorities. Automakers now see hybrids, plug-in hybrids, and extended-range solutions as bridges that satisfy current needs while keeping electrification pathways open.

Strategic Adjustments by Major Players

Each of the Detroit Three has responded in ways that reflect their unique portfolios and market positions.

General Motors maintains one of the broadest EV lineups among legacy manufacturers but has taken decisive steps to match output with demand:

Paused battery production at joint-venture facilities

Reduced shifts at dedicated EV assembly plants

Repurposed planned EV factories toward full-size pickups and SUVs

These moves aim to avoid oversupply while preserving flexibility for future growth.

Ford has executed perhaps the most dramatic pivot:

Scrapped plans for several second-generation all-electric models

Shifted focus toward smaller, more affordable future EVs

Redirected battery plant capacity partly toward energy storage systems

Emphasized hybrid and extended-range technologies for trucks

The company views these changes as essential for long-term profitability and relevance.

Stellantis has similarly recalibrated:

Delayed or discontinued certain pure-electric truck programs

Reintroduced combustion options to iconic nameplates

Invested heavily in gas-powered and hybrid alternatives

Across the board, manufacturers are taking financial charges to realign operations, signaling that flexibility trumps rigid adherence to earlier timelines.

The Rise of Bridge Technologies

One of the clearest outcomes of this period is the resurgence of hybrid powertrains. These systems deliver:

Improved fuel efficiency without range limitations

Familiar refueling habits at any gas station

Lower entry barriers compared to full EVs

Reduced emissions versus traditional engines

Many analysts view hybrids as a pragmatic interim step — allowing infrastructure to mature, battery technology to advance further, and consumer comfort levels to rise. Extended-range electric vehicles, which combine modest battery packs with efficient gasoline generators, have also gained traction, particularly in truck and SUV segments where utility matters most.

Looking Toward a More Balanced Future

The current recalibration does not represent abandonment of electrification. Automakers continue developing next-generation platforms, exploring solid-state batteries, and investing in software-defined vehicles. They simply operate with greater realism about adoption curves.

Market forces now dictate pace rather than mandates alone. As charging networks expand, battery costs decline further, and more affordable models arrive, demand patterns may shift again. Until then, U.S. manufacturers are positioning themselves to profit from today's preferences while remaining prepared for tomorrow's possibilities.

The industry has learned that sustainable transitions require alignment between innovation and actual customer behavior — a lesson likely to shape mobility strategies for years to come.

More from News

Chinese EVs Flooding North America? Xiaomi SU7, BYD & More Coming

07.01.2026 14:22

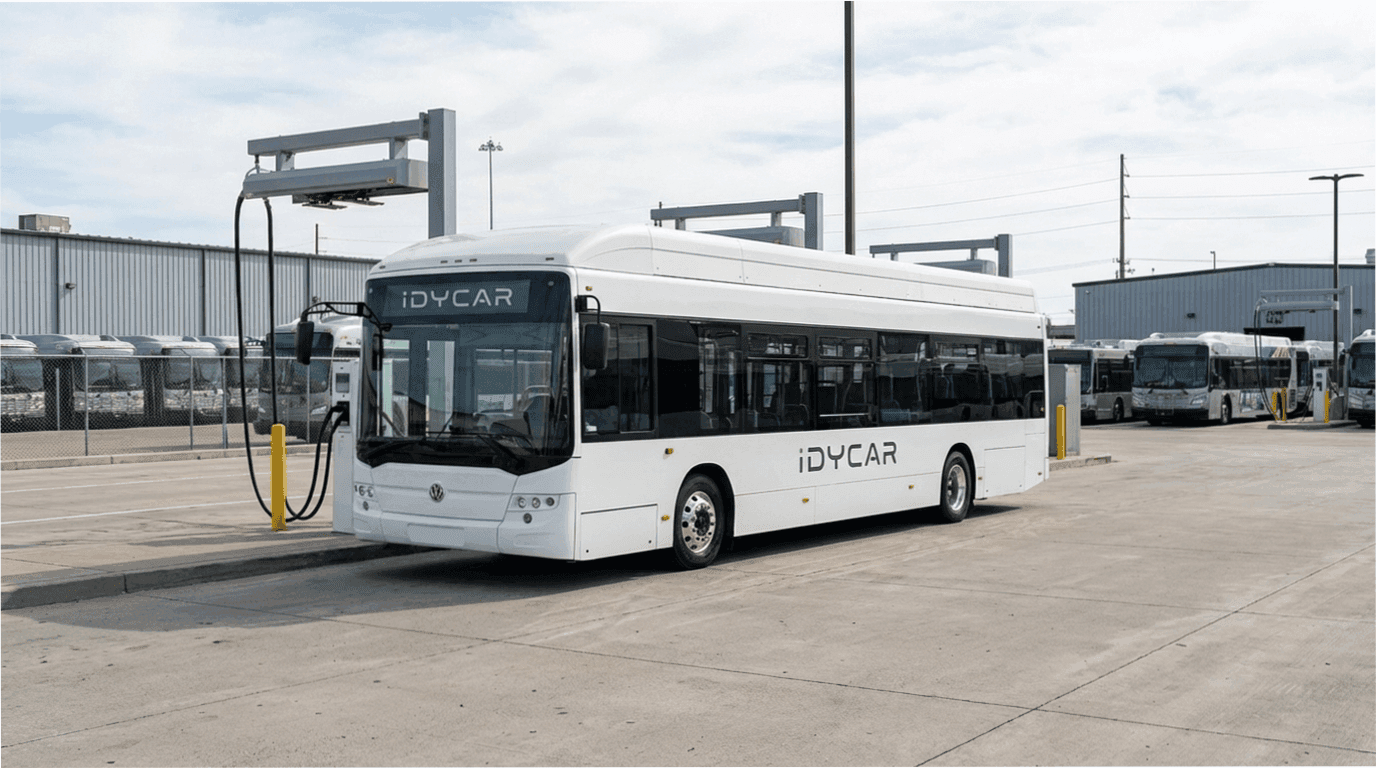

Volkswagen Halts Imports of Its Electric Bus to the U.S. Next Year

Policy uncertainty, rising costs, and weaker demand force Volkswagen to pause its electric bus expansion

22.12.2025 18:03

Ram TRX Returns with 777hp Supercharged V8 — Muscle Truck Wars Heat Up

07.01.2026 17:24

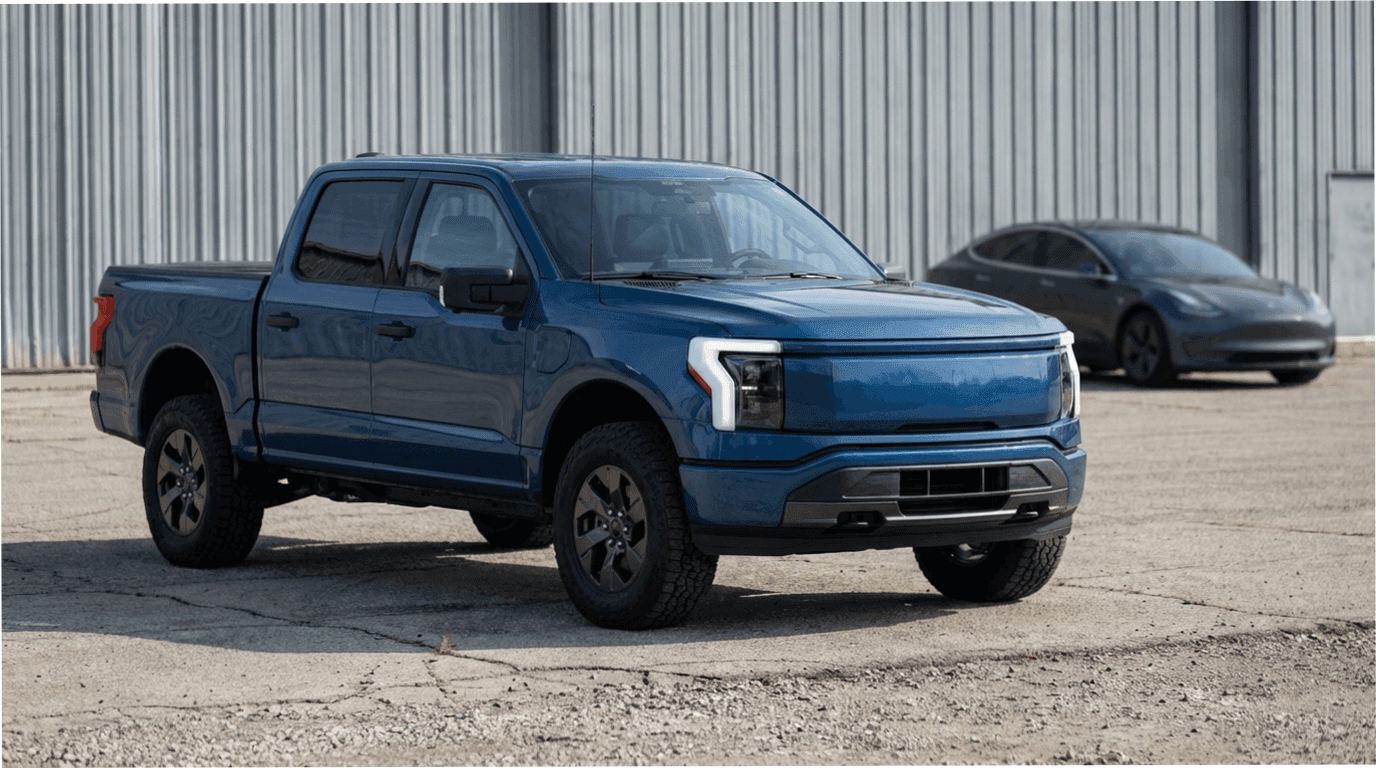

Why Ford Couldn’t Replicate Tesla’s EV Success

The electric F-150 impressed on paper but failed to meet the expectations set by Tesla

22.12.2025 18:47

Ford Shatters Recall Record — 12.9 Million Vehicles in 2025 Alone

08.01.2026 15:52