Industry pivots toward hybrids, affordable options, and balanced powertrains

The automotive landscape has undergone a profound transformation in recent times. After years of aggressive bets on full electrification, major manufacturers are recalibrating their strategies to better align with real-world consumer behavior, economic realities, and infrastructure limitations. The result is a clear industry-wide pivot toward hybrid powertrains, more accessible vehicle segments, and a pragmatic multi-pathway approach to propulsion technologies.

This shift represents not a retreat from progress, but a more mature understanding of how people actually buy and use cars today.

Why the Sudden Emphasis on Hybrids?

Hybrids have quietly evolved from niche fuel-savers into mainstream solutions that address the most common customer pain points.

Here are the key drivers behind their dramatic resurgence:

No charging anxiety — drivers fuel up in minutes at any gas station

Seamless transition — no major changes to daily routines or home infrastructure needed

Significant fuel savings — often 40-50% better efficiency than comparable gasoline models

Lower entry barriers — hybrids typically cost less to produce than full battery-electric equivalents

Regulatory flexibility — they help manufacturers meet emissions targets without betting everything on one technology

What once seemed like a compromise now feels like the most rational choice for millions of households. Manufacturers who mastered hybrid systems years ago now enjoy a substantial competitive advantage, while others rush to catch up by reallocating development budgets toward gas-electric architectures.

The Rise of Affordable and Practical Segments

Parallel to the hybrid surge comes renewed focus on vehicles that ordinary families can actually consider buying without stretching finances to the breaking point.

Automakers are rediscovering the value of:

Compact and subcompact cars with hybrid options

Sensibly sized crossovers and small SUVs

Entry-level sedans that prioritize efficiency and reliability

Work-oriented trucks and vans with electrified assistance

This return to accessible segments stands in stark contrast to the previous obsession with premium full-size SUVs and luxury electric flagships. Market data shows buyers increasingly cross-shop across new and used, gas, hybrid, and electric — always hunting for the lowest total cost of ownership.

The segment renaissance proves that volume and profitability can coexist when products genuinely solve everyday problems rather than chase technological headlines.

Balanced Powertrains: The New Industry Philosophy

The most significant philosophical change is the widespread embrace of multi-powertrain strategies — what some experts now call the "mosaic of propulsion technologies."

Instead of an all-or-nothing approach, leading companies now develop parallel technology paths:

Traditional efficient internal combustion engines for price-sensitive buyers

Conventional (non-plug-in) hybrids for mainstream efficiency gains

Plug-in hybrids with meaningful electric range for commuters

Extended-range electric vehicles (larger battery + small generator) for those wanting EV-like driving with ultimate flexibility

Full battery-electric models targeted at urban environments and early adopters

This diversified portfolio allows manufacturers to:

Serve dramatically different regional markets

Respond quickly to policy changes

Maintain profitability across economic cycles

Gradually build consumer familiarity with electrification

The balanced approach reduces risk while keeping genuine progress toward lower emissions — just at a more realistic pace.

Consumer Priorities Have Reshaped the Roadmap

Today's car buyers consistently rank several factors above pure zero-emission performance:

Total cost of ownership (fuel + maintenance + insurance)

Driving range confidence on long trips

Resale value predictability

Repairability through existing service networks

Practicality for families and active lifestyles

Hybrids and well-priced conventional models tend to deliver better scores across these real-world criteria for the majority of households. As a result, market forces — rather than regulatory mandates alone — are now steering product planning.

Buyers have spoken clearly: they want meaningful environmental benefits without forced lifestyle compromises. The industry has finally started listening.

Technology Improvements Make Hybrids Even More Appealing

Modern hybrid systems bear little resemblance to early-generation designs. Recent advances include:

Smoother transitions between electric and gasoline modes

Larger electric-only ranges in plug-in versions (often 40-60 miles)

More powerful electric motors for better acceleration

Regenerative braking that feels natural and effective

Battery packs that last the life of the vehicle

Integration with advanced driver-assistance systems

These engineering enhancements have turned hybrids from "good enough" compromises into genuinely desirable vehicles that often outperform their gasoline-only counterparts in driving enjoyment and refinement.

What This Means for the Road Ahead

The current pivot toward hybrids, affordability, and powertrain diversity signals a more sustainable — and commercially viable — path for the automotive industry. Rather than forcing rapid change, manufacturers are now enabling gradual, consumer-led evolution toward cleaner mobility.

This pragmatic strategy keeps innovation alive while respecting economic realities, infrastructure limitations, and diverse customer needs. It positions the industry to deliver meaningful CO₂ reductions over the coming decades without asking the majority of drivers to accept major compromises today.

The era of one-size-fits-all electrification appears to be ending. In its place emerges a smarter, more flexible future where hybrids serve as the practical bridge — and, for many, perhaps the long-term destination.

More from News

Chinese EVs Flooding North America? Xiaomi SU7, BYD & More Coming

07.01.2026 14:22

Ram TRX Returns with 777hp Supercharged V8 — Muscle Truck Wars Heat Up

07.01.2026 17:24

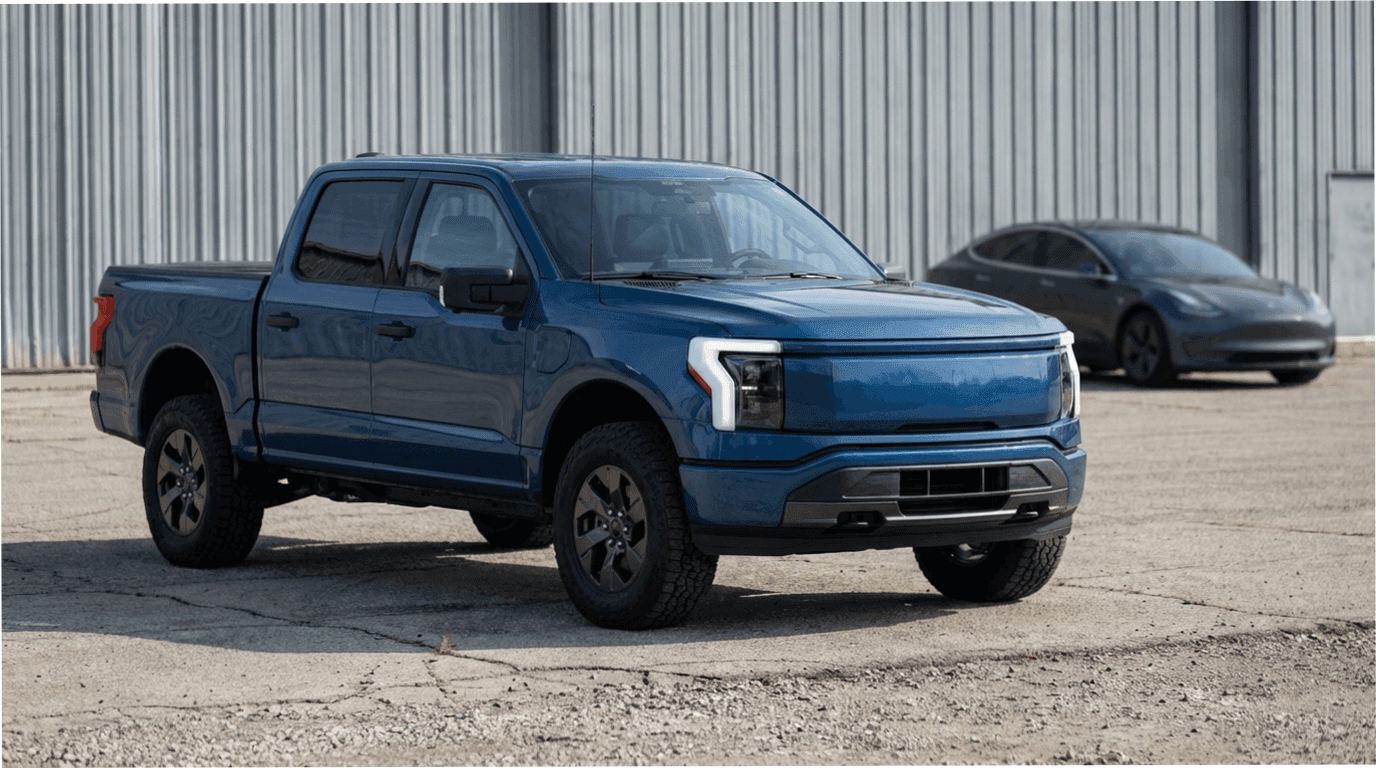

Why Ford Couldn’t Replicate Tesla’s EV Success

The electric F-150 impressed on paper but failed to meet the expectations set by Tesla

22.12.2025 18:47

Ford Shatters Recall Record — 12.9 Million Vehicles in 2025 Alone

08.01.2026 15:52

Hyundai & Kia Recall Over 1 Million Vehicles — What’s Actually Failing?

08.01.2026 15:40