Shift Back to Hybrids and ICE as EV Momentum Slows

The automotive world is experiencing one of its most significant strategic pivots in recent memory. After years of aggressive investment in full battery-electric vehicles (BEVs), many major manufacturers are quietly — and in some cases quite publicly — recalibrating their portfolios. The once-unstoppable narrative of rapid electrification is giving way to a more pragmatic reality: hybrids, plug-in hybrids, and even refined internal combustion engine (ICE) models are reclaiming center stage in many markets.

This shift is not a rejection of electrification altogether, but rather a recognition that consumer behavior, infrastructure limitations, and economic realities demand a more balanced approach.

Why the EV Surge Has Lost Steam

Several converging factors have cooled the once-explosive growth of pure electric vehicles, particularly in key Western markets.

Infrastructure still lags behind ambition — Public charging networks remain unevenly distributed, with significant gaps in rural areas and along long-distance routes. Many potential buyers cite "range anxiety" and inconvenient charging times as persistent barriers.

Real-world usability concerns — Cold weather dramatically reduces battery range, sometimes by 30–40%, while home charging isn't feasible for everyone living in apartments or older housing stock without dedicated outlets.

Economic pressures on consumers — Higher upfront costs, combined with uncertainty about long-term battery health and repair expenses, make many households hesitate when fuel prices remain relatively stable.

Policy uncertainty and incentive changes — The removal or modification of generous subsidies in several countries has removed a major artificial demand driver that previously masked underlying market readiness.

These elements together have created a more cautious buyer mindset, leading to slower adoption rates than most forecasts predicted just a few years ago.

Hybrids: The Sensible Middle Ground

Hybrids — both conventional (HEV) and plug-in (PHEV) varieties — have emerged as the biggest beneficiaries of the current market dynamics.

They deliver the best of both worlds: meaningful fuel savings and reduced emissions from the electric component, without forcing owners into a full commitment to battery-only driving.

Key advantages driving their resurgence include:

Seamless transition between electric and gasoline power — no need to plan every trip around charging stops

Extended total range that rivals or exceeds conventional ICE vehicles

Familiar refueling experience when the battery is depleted

Lower overall ownership stress compared to pure EVs, especially for families or those with long commutes

Strong resale value retention in markets where EV depreciation has proven steeper than expected

Manufacturers that maintained hybrid expertise — particularly Japanese brands — are now seeing their patience pay off handsomely. Meanwhile, companies that previously de-emphasized hybrids are rapidly expanding lineups or reviving previously shelved programs.

ICE Vehicles: Far From Obsolete

Contrary to earlier predictions, internal combustion engines are not fading into irrelevance. Instead, they are evolving.

Modern ICE powertrains benefit from:

Decades of continuous refinement leading to impressive efficiency gains

Advanced turbocharging, direct injection, and variable compression technologies

Integration of mild-hybrid systems that provide electric assist without full hybridization complexity

Lower development costs compared to building entirely new EV architectures

For segments like full-size trucks, heavy-duty SUVs, and vehicles used in remote areas, ICE powertrains still offer unmatched capability, towing capacity, and refueling convenience. Several manufacturers have quietly increased investment in next-generation efficient gasoline and diesel engines, recognizing that a significant portion of buyers will remain loyal to this proven technology for years to come.

How Automakers Are Adapting Their Strategies

The industry's response has been swift and multifaceted.

Many companies have delayed or scaled back ambitious all-EV timelines, redirecting capital toward more immediately profitable segments.

Reallocating production lines to prioritize hybrid models

Reviving or accelerating ICE refreshes in high-demand categories like pickups and large SUVs

Developing flexible vehicle platforms capable of supporting multiple powertrain types

Focusing R&D on next-generation hybrid systems, including extended-range configurations

This pragmatic pivot allows manufacturers to maintain profitability while continuing incremental progress toward electrification — but at a pace more closely aligned with actual market demand.

Regional Differences Shape the Transition

The slowdown is far from uniform across the globe.

Markets with robust charging infrastructure and sustained policy support continue to show stronger EV uptake. In contrast, regions with vast rural territories, colder climates, or recent policy reversals are experiencing the most pronounced return toward hybrids and ICE.

This geographic divergence suggests that the path to widespread electrification will be staggered rather than synchronized — a reality the industry is finally beginning to accept.

What Comes Next for the Powertrain Mix

The current market adjustment does not signal the end of electrification — far from it. Battery technology continues to improve, costs are trending downward over the long term, and environmental pressures remain unrelenting.

However, the industry has learned a crucial lesson: technology adoption follows consumer readiness, not corporate timelines or regulatory wishes.

The next decade will likely feature a diverse powertrain landscape:

Growing but selective role for battery-electric vehicles in urban and premium segments

Dominant position for hybrids as the mainstream transition technology

Persistent relevance of highly efficient ICE engines in specific use cases

Gradual emergence of new synthetic fuels and hydrogen solutions for niche applications

This multi-path approach may ultimately prove faster and more sustainable than forcing a single-solution strategy.

The automotive world has not abandoned the electric future — it has simply chosen a more realistic road to reach it.

More from News

Chinese EVs Flooding North America? Xiaomi SU7, BYD & More Coming

07.01.2026 14:22

Ram TRX Returns with 777hp Supercharged V8 — Muscle Truck Wars Heat Up

07.01.2026 17:24

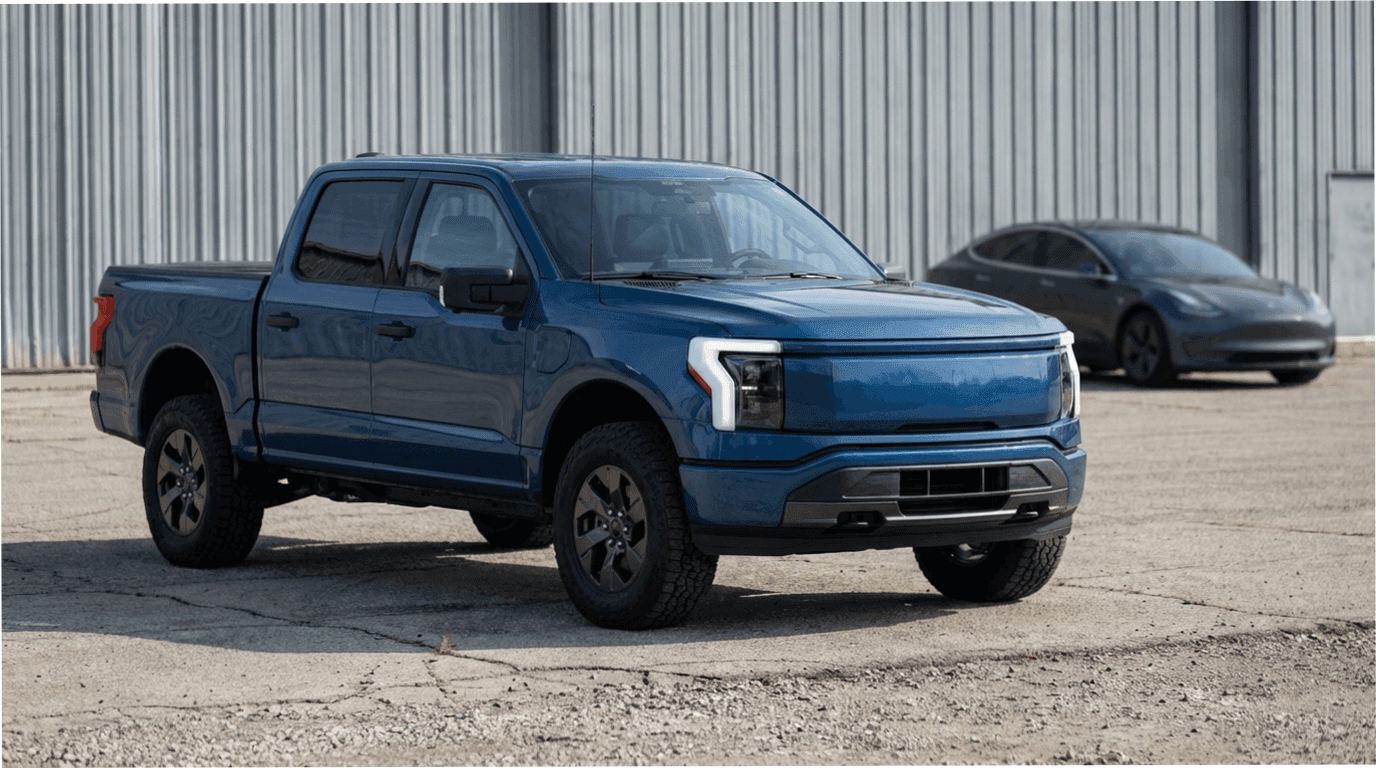

Why Ford Couldn’t Replicate Tesla’s EV Success

The electric F-150 impressed on paper but failed to meet the expectations set by Tesla

22.12.2025 18:47

Ford Shatters Recall Record — 12.9 Million Vehicles in 2025 Alone

08.01.2026 15:52

Hyundai & Kia Recall Over 1 Million Vehicles — What’s Actually Failing?

08.01.2026 15:40