Tariffs and policy changes expected to drive higher vehicle prices

The automotive industry stands at a crossroads where trade policy directly reshapes affordability. Recent shifts toward protectionism, particularly through elevated import duties, have created a new economic reality for manufacturers, suppliers, and consumers alike. These changes aim to bolster domestic production but introduce substantial cost pressures across global supply chains that have operated with relative freedom for decades.

The Mechanics of Modern Automotive Tariffs

Tariffs function as taxes levied on imported goods, designed to make foreign products less competitive against locally produced alternatives. In the vehicle sector, duties now target both finished automobiles and the thousands of components that cross borders multiple times during assembly.

Key elements driving cost escalation include:

Higher duties on finished vehicles from major trading partners, significantly above historical baseline rates

Expanded tariffs on critical auto parts, affecting even vehicles assembled domestically

Reduced exemptions under regional trade frameworks, limiting previous cost-saving loopholes

Retaliatory measures from other nations, complicating export strategies for manufacturers

This layered approach disrupts the finely tuned North American and global supply networks that kept production efficient and costs manageable.

Why Nearly Every Vehicle Feels the Impact

Contrary to common assumptions, purely domestic vehicles remain largely unaffected. Modern automobiles incorporate parts sourced worldwide, with engines, transmissions, electronics, and batteries frequently crossing borders before final assembly.

This interconnectedness means:

Even U.S.-built models rely heavily on imported components

Vehicles assembled in neighboring countries face full import levies

Luxury and performance segments, often reliant on specialized foreign parts, experience pronounced effects

Electric vehicle platforms, dependent on global battery and semiconductor supply chains, encounter additional layers of cost pressure

The result is a broad-based upward push on production expenses that manufacturers struggle to fully absorb.

Manufacturer Strategies in Response to Rising Costs

Automakers face difficult choices when confronted with sustained higher input expenses. Initial responses often involve short-term absorption to preserve market share, but prolonged pressure forces more structural adjustments.

Common strategies observed across the industry include:

Selective price adjustments tied to new model-year introductions

Reductions in complimentary services, such as extended maintenance packages

Increases in destination and delivery fees to offset logistics and tariff-related burdens

Temporary pauses in imports or production shifts to manage inventory

Accelerated investment in localized manufacturing to qualify for lower duties

These moves represent pragmatic attempts to balance profitability with competitive positioning in a changing trade landscape.

Supply Chain Reconfiguration and Long-Term Shifts

Tariffs accelerate trends already underway toward regionalization of production. Manufacturers increasingly evaluate "nearshoring" or full domestication of key operations to minimize exposure to import duties.

This transition involves:

Building or expanding facilities closer to major markets

Developing deeper relationships with local suppliers

Re-engineering components to meet regional content requirements

Diversifying sourcing away from high-tariff origins

While these changes promise greater resilience over time, they require years of capital investment and carry substantial upfront expenses that contribute to near-term cost pressures.

Consumer Experience in a Tariff-Influenced Market

Buyers encounter a transformed purchasing environment where affordability dynamics evolve rapidly. Pre-tariff inventory often sells quickly as consumers anticipate future increases, creating temporary surges in demand followed by adjustment periods.

Market behavior patterns include:

Rush purchases of current models before adjustments take full effect

Growing interest in certified pre-owned vehicles unaffected by new import duties

Increased consideration of domestically assembled options

Heightened sensitivity to total ownership costs beyond the initial transaction

Dealer-level incentives becoming more creative to maintain volume

These adaptations reflect how consumers navigate an industry forced to recalibrate under policy-driven cost realities.

Broader Economic Ripples Beyond the Dealership

Vehicle price escalation extends influence across related sectors. Higher new-vehicle costs typically strengthen demand in the used market, which can create secondary upward pressure on pre-owned values. Repair and maintenance expenses also rise as imported parts become more expensive, affecting insurance premiums and long-term ownership economics.

Fleet operators and commercial buyers face particularly complex decisions, weighing replacement cycles against elevated acquisition and operational costs in an uncertain trade environment.

The interplay of tariffs and policy evolution continues to redefine expectations in the automotive space. As manufacturers adapt supply chains, refine pricing approaches, and invest in localization, the industry moves toward a more regionally oriented future. For consumers, these developments translate into a market where strategic timing, careful model selection, and awareness of total costs become essential elements of the buying process.

More from News

Chinese EVs Flooding North America? Xiaomi SU7, BYD & More Coming

07.01.2026 14:22

Ram TRX Returns with 777hp Supercharged V8 — Muscle Truck Wars Heat Up

07.01.2026 17:24

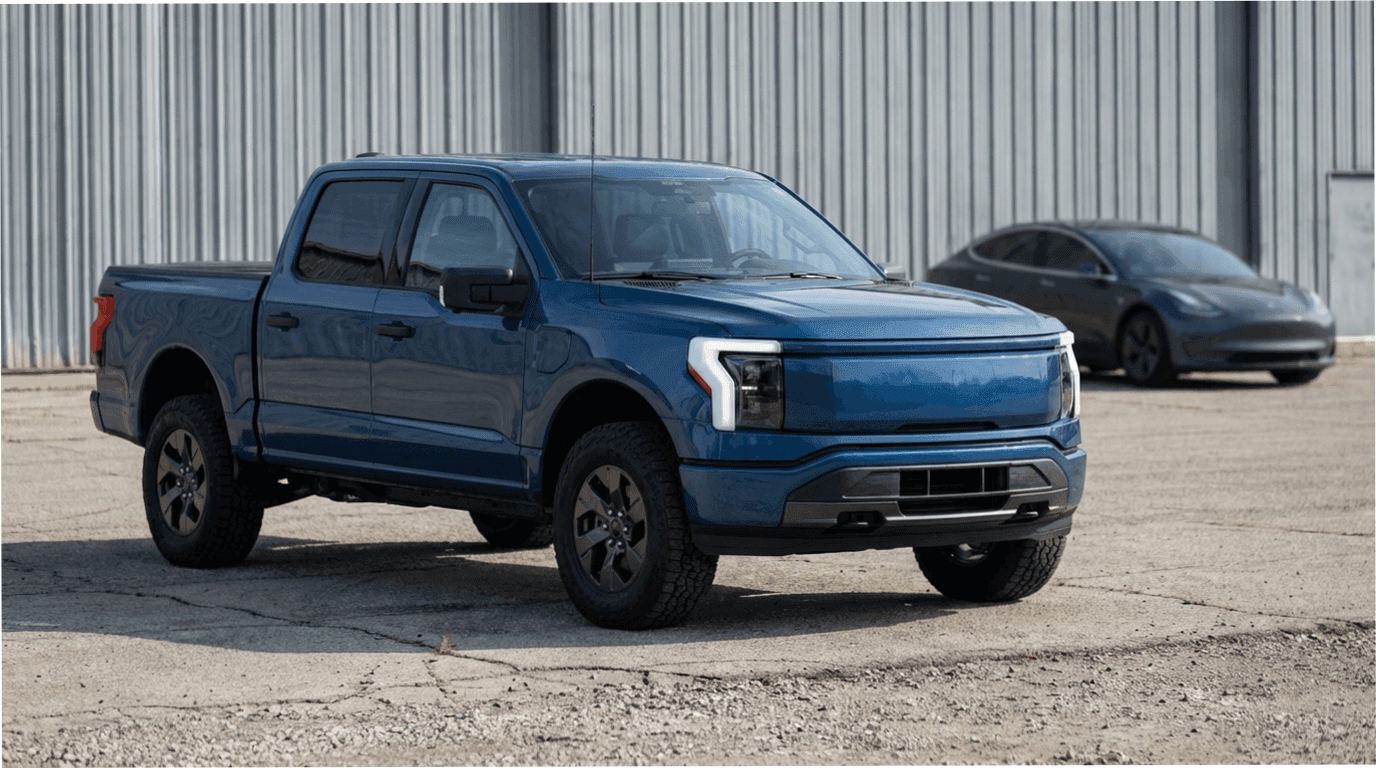

Why Ford Couldn’t Replicate Tesla’s EV Success

The electric F-150 impressed on paper but failed to meet the expectations set by Tesla

22.12.2025 18:47

Ford Shatters Recall Record — 12.9 Million Vehicles in 2025 Alone

08.01.2026 15:52

Hyundai & Kia Recall Over 1 Million Vehicles — What’s Actually Failing?

08.01.2026 15:40