Volkswagen Halts Imports of Its Electric Bus to the U.S. Next Year

Policy uncertainty, rising costs, and weaker demand force Volkswagen to pause its electric bus expansion

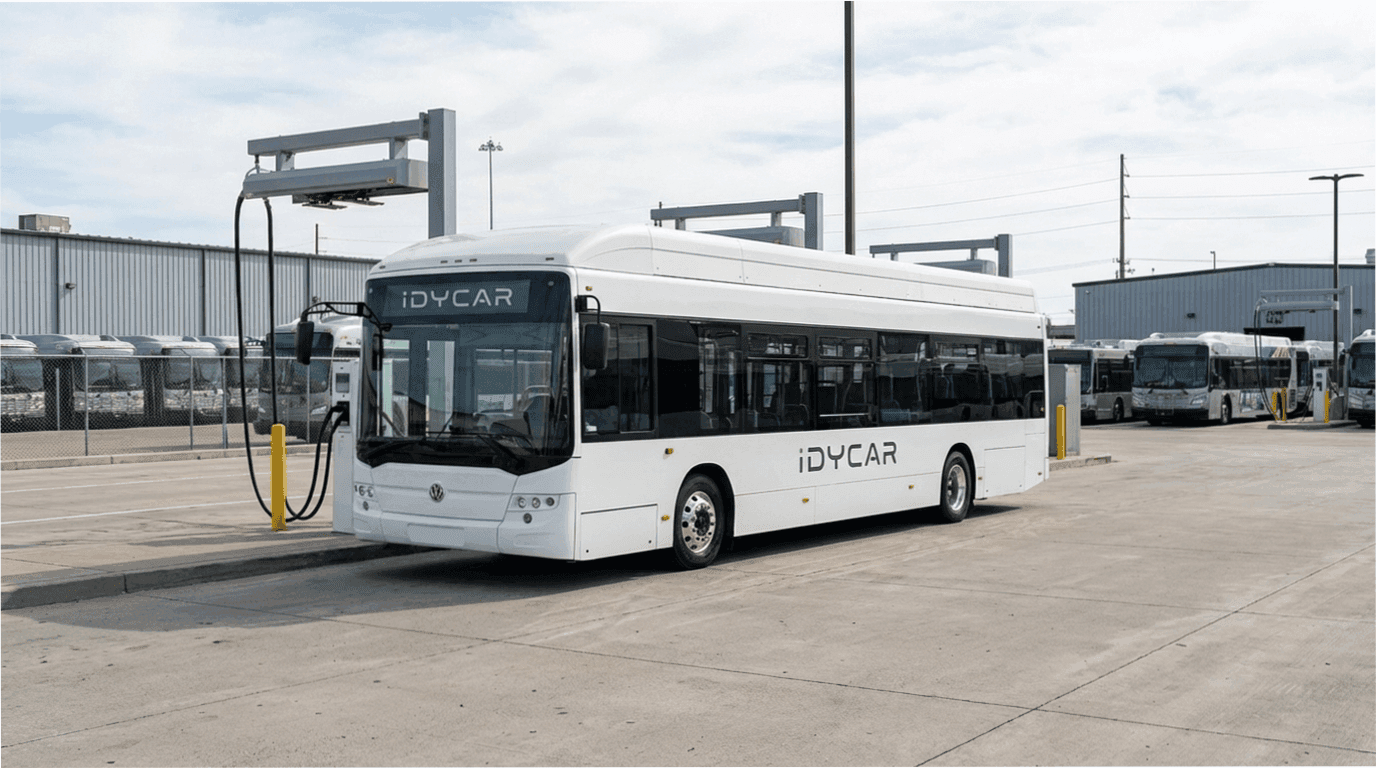

Volkswagen has announced that it will halt imports of its electric bus to the United States starting next year, a decision that highlights the growing challenges facing electric vehicle adoption in the U.S. commercial and public transportation sectors. The move affects Volkswagen’s battery-electric bus lineup and signals a more cautious approach to electrification amid shifting regulations, cost pressures, and uncertain demand.

For U.S. transit agencies and municipal fleet operators, the decision reduces an already limited pool of electric bus options from major global manufacturers. For the broader auto and mobility industry, it underscores how sensitive electrification strategies remain to policy stability and long-term funding commitments.

Why Volkswagen Is Pausing Electric Bus Imports

Volkswagen’s electric bus program was designed to support long-term climate and sustainability goals, particularly for urban public transportation. However, the economic and regulatory environment in the United States has changed significantly over the past year. Reduced incentives for zero-emission vehicles, evolving emissions targets, and uncertainty around future federal and state-level requirements have made large-scale electric bus deployments more difficult to justify.

According to guidance linked to U.S. emissions and clean transportation regulations, public agencies face increasingly complex compliance frameworks that differ by state, funding source, and project type. While some cities remain committed to zero-emission fleets, others are delaying procurement decisions or turning back to hybrid and low-emission diesel alternatives in order to manage near-term costs.

Cost Pressures and Infrastructure Challenges

Electric buses remain significantly more expensive than diesel or hybrid models, even before accounting for infrastructure investments. Charging stations, grid upgrades, depot retrofitting, and staff training all add to total cost of ownership. For transit agencies operating under fixed budgets or declining federal support, these additional costs are increasingly difficult to absorb.

In many cases, the long-term savings promised by electric buses depend heavily on stable electricity pricing, predictable maintenance costs, and sustained policy support. When any of these variables change, the financial case weakens rapidly. As a result, some agencies are postponing electrification plans or scaling them back to pilot programs rather than full fleet conversions.

Trade, Manufacturing, and Procurement Realities

Importing large electric commercial vehicles into the U.S. exposes manufacturers to trade-related risks, including tariffs, currency fluctuations, and logistical complexity. Domestic or regionally assembled vehicles often align more easily with public procurement rules, “Buy America” requirements, and local funding conditions.

Volkswagen’s decision reflects a broader reassessment across the commercial vehicle sector. Rather than pushing imported electric platforms into an increasingly uncertain market, manufacturers are exploring alternative strategies, including local assembly, partnerships with domestic suppliers, or a greater emphasis on hybrid powertrains.

Regulatory Shifts Are Slowing Electrification Momentum

The pause also coincides with changes in U.S. auto and transportation policy. Adjustments to fuel economy and efficiency programs have reduced pressure on manufacturers to prioritize electric-only solutions, particularly in commercial and fleet segments. Recent updates to Corporate Average Fuel Economy (CAFE) standards have eased near-term compliance demands, giving manufacturers more flexibility to delay or scale back electric offerings.

Without strong and consistent regulatory signals, electrification timelines become harder to justify internally, especially for capital-intensive products like electric buses.

Impact on U.S. Transit Agencies

For cities and transit authorities that had planned to incorporate Volkswagen’s electric buses into their fleets, the halt may require revisiting procurement strategies. Options include extending the lifespan of existing diesel fleets, purchasing hybrid buses, or sourcing electric models from smaller domestic manufacturers, often at higher cost or with longer delivery timelines.

The decision also highlights a broader issue facing public transportation electrification: progress depends not only on technology availability, but on stable funding, infrastructure readiness, and long-term policy clarity. Without alignment across these areas, even well-established automakers are reluctant to commit fully.

A Signal of a Slower, More Fragmented Transition

Volkswagen has not abandoned electric mobility, but the pause signals a more pragmatic and risk-aware strategy. Rather than continuing imports under uncertain conditions, the company appears to be waiting for clearer market signals — whether through renewed incentives, stronger mandates, or more predictable demand from transit operators.

In the broader context, Volkswagen’s move serves as a reminder that electrification is not a linear process. It is shaped by economics, regulation, and public-sector decision-making as much as by technology. As a result, the transition to electric public transportation in the United States may prove slower and more uneven than originally anticipated.

More from News

Why Tesla’s Latest Earnings Report Is a Warning Sign — And What It Means for the EV Market

02.12.2025 17:19

The Race to Build Electric Motors Without Chinese Rare Earths

02.12.2025 17:03

Trump Points to Japan’s ‘Cute’ Tiny Cars as a Solution to Soaring Vehicle Costs

14.12.2025 17:12

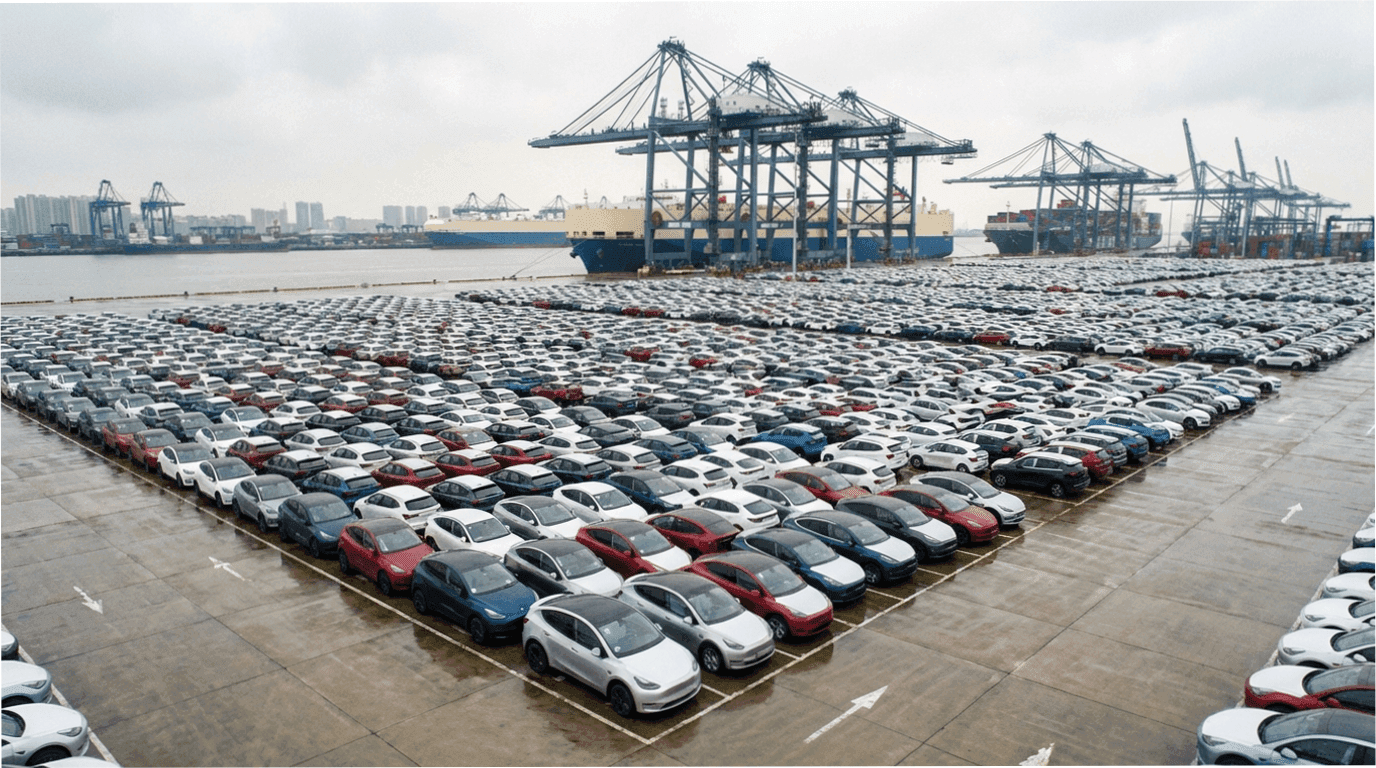

China’s Auto Sales Decline for a Second Month, but Exports Hit Record Highs

09.12.2025 16:05

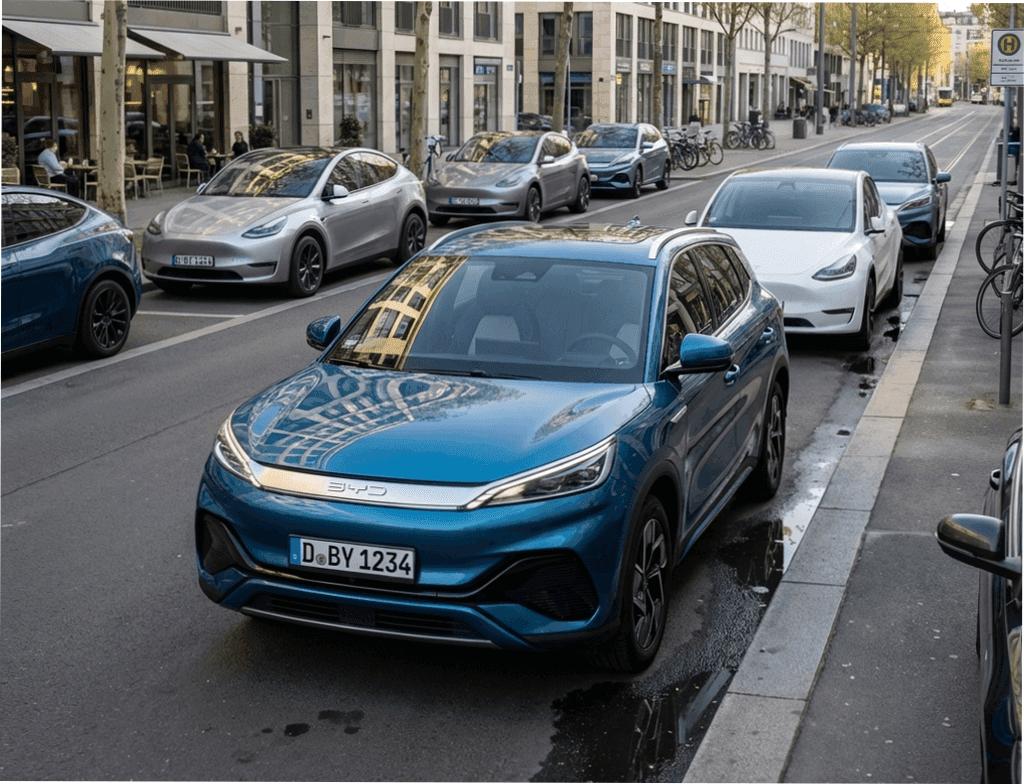

BYD’s European Sales Surge as Chinese Automakers Expand Across the Continent

02.12.2025 17:11