Tesla Cybertruck sales slump: Recalls and rust scare buyers

The Tesla Cybertruck, once hailed as a revolutionary electric pickup with its bold angular design and stainless steel exoskeleton, has faced a turbulent journey on the market. What started as immense hype with millions of reservations has evolved into a noticeable decline in demand. Persistent quality issues, including multiple recalls and unexpected corrosion problems, have eroded consumer confidence, leading many potential buyers to hesitate or look elsewhere in the competitive EV truck segment.

The Wave of Recalls Undermining Trust

Since deliveries began, the Cybertruck has been hit with an unusually high number of recalls, far exceeding typical new model teething problems. These safety-related fixes have affected nearly every vehicle produced, highlighting challenges in manufacturing precision and component reliability.

Key recalls have included:

Accelerator pedal pads that could shift and become stuck, causing unintended acceleration risks.

Exterior trim panels and cant rails detaching due to inadequate adhesion, potentially creating road hazards.

Off-road light bar accessories prone to falling off while driving.

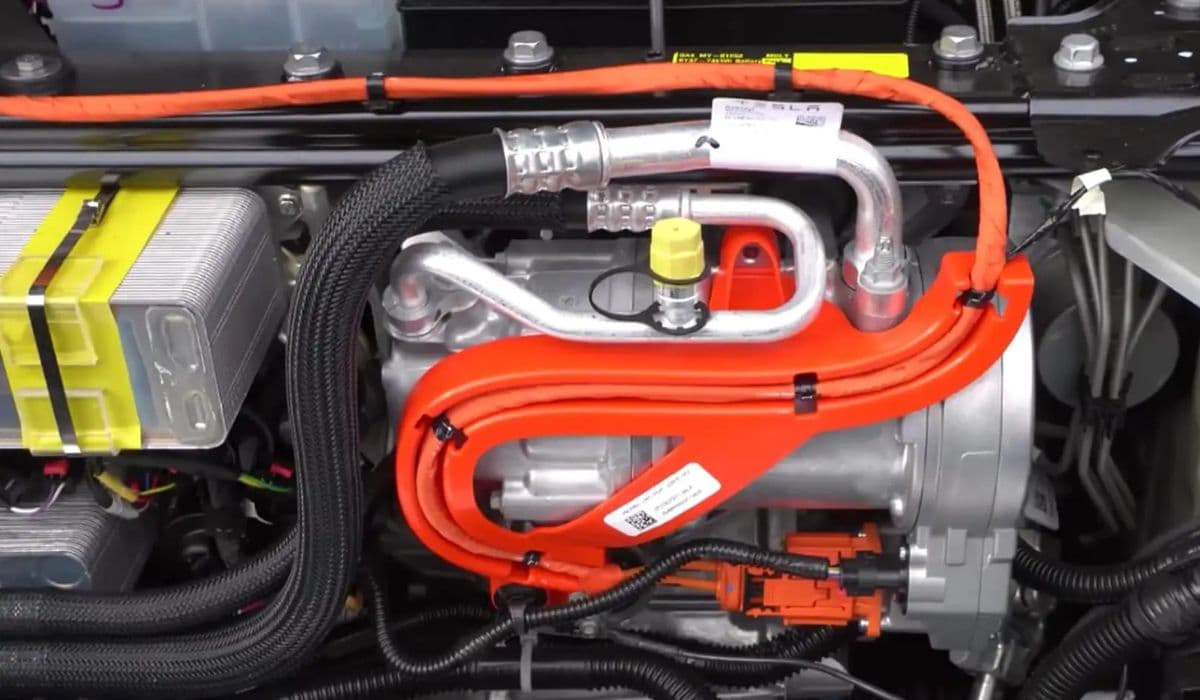

Drive inverter faults leading to sudden loss of power.

Overly bright headlights or parking lights exceeding regulatory limits.

Windshield wiper motor failures and software glitches affecting warning indicators.

These issues often required physical service visits rather than simple over-the-air updates, frustrating owners and amplifying perceptions of rushed production. With recalls covering tens of thousands of units—sometimes nearly all on the road—the cumulative effect has been a significant blow to the model's reputation for bulletproof durability.

The Persistent Rust Controversy

One of the most surprising complaints centers on the Cybertruck's signature stainless steel body. Marketed as ultra-hard and corrosion-resistant, the material was supposed to set the vehicle apart from traditional painted trucks. However, owners quickly reported orange spots and surface corrosion appearing after exposure to rain, road salt, or even mild weather conditions.

While Tesla maintains these are not true rust but surface contaminants—like iron particles from rail transport or environmental debris—that can be polished off, the reality for owners has been different:

Spots reappearing after cleaning, especially in humid or salty environments.

Need for regular maintenance with specific cleaners to preserve the bare metal finish.

Concerns in colder climates where de-icing salts accelerate the issue.

This has sparked debates in owner forums, with some describing the upkeep as more demanding than expected for a premium truck. The lack of a standard clear coat leaves the steel vulnerable, turning what was pitched as a low-maintenance feature into a potential ongoing hassle.

Impact on Sales and Buyer Sentiment

The combination of frequent recalls and rust reports has contributed to a sharp slowdown in Cybertruck momentum. Initial enthusiasm gave way to caution as real-world experiences spread through social media and owner communities.

Factors deterring buyers include:

Fear of ongoing repairs and downtime from recalls.

Worries about long-term body integrity in varied climates.

Growing inventory piles at dealerships, signaling softer demand.

Competition from rivals offering more conventional designs with proven reliability.

Sales figures reflect this shift, with quarterly deliveries dropping significantly compared to peak periods. While the Cybertruck still appeals to a niche of early adopters drawn to its futuristic aesthetic and performance, broader truck buyers—prioritizing rugged dependability—appear increasingly wary.

What Lies Ahead for the Cybertruck

Tesla continues to address these challenges through engineering updates and service campaigns, aiming to refine the vehicle over time. Improvements in adhesion techniques, software refinements, and owner guidance on steel care show commitment to resolution. Yet, rebuilding eroded trust will require consistent proof of reliability on the road.

For prospective buyers, the Cybertruck remains a striking option for those valuing innovation and off-grid capability. However, the lessons from its rollout underscore the difficulties of bringing radical designs to mass production without compromises. As the EV pickup market matures, overcoming these hurdles could determine whether the Cybertruck rebounds or remains a polarizing chapter in automotive history.

More from Tesla

Tesla battery degradation after 100K miles: Real owner data

17.12.2025 15:27

Overall Tesla ownership cost 2025: Cheaper than gas after 3 years?

17.12.2025 12:13

Tesla Cybertruck vs Ford F-150 Lightning: Towing and charging showdown

17.12.2025 05:57

2025 refreshed Tesla Model X: Worth upgrading from old raven?

17.12.2025 04:14

Tesla heat pump problems in winter: 2025 still an issue?

17.12.2025 01:02